Canara Robeco Emerging Equities: A top performing mid & small cap fund in the last 5 years

As you know investments in equity or equity oriented mutual funds are suitable to investors with moderately high to high risk profile. Within the equity funds categories, mid & small cap funds and sectoral funds have the highest risk. However, if you can take high risk, then mid & small cap funds can be the most rewarding too.

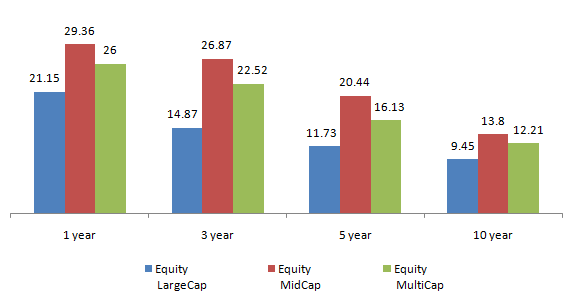

As you can see in the chart below, the equity midcap category has significantly surpassed the returns of large cap and diversified equity fund categories over different time periods. The last one year has been very good for mid and small cap funds as they generated significantly superior returns compared to large cap and diversified equity funds over the last 1, 3, 5 and even 10 year periods, as can be seen in the chart below (NAVs as on March 04, 2017).

Source: ValueExpress

If you see the chart above, the return percentage difference between large cap versus midcap funds has been as high as 8%, 11%, 9% and 4% in the 1, 3, 5 and 10 year periods respectively. Again, if you compare the midcap funds versus diversified equity funds the annualised return difference percentage is in the range of 3-4% which is also quite significant. As these category return gaps are significantly high, you can benefit by investing a portion of your mutual fund portfolio into mid & small cap funds, albeit by taking a bit higher risk.

Within the midcap funds category, Canara Robeco Emerging Equities Fund has been one of the top performing funds in the mid & small cap fund category in the last 5 years. With almost 12 years of continued strong performance (annual CAGR of 18.14% since inception), this fund has proved how mid & small cap fund can create wealth for investors if they can take a bit higher risk and have a long term investment horizon.

Canara Robeco Emerging Equities Fund had a difficult time between 2006 and 2008 but has got its act together quite well since 2009 and out performed both in the bear market of 2011 and in the bull markets of 2009 and 2014.

In the last 5 years, the fund has delivered more than 3 times absolute returns. Had you invested Rs 1 Lakh 5 years back then your investment would have grown to Rs 3.33 Lakhs (based on NAV of 7/3/2017)

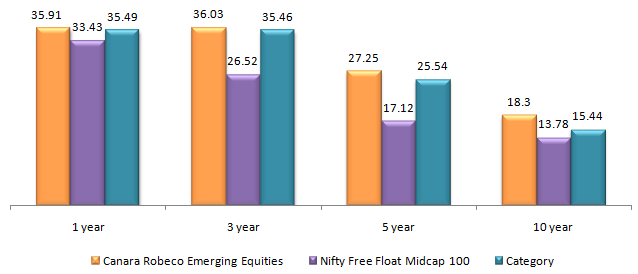

Canara Robeco Emerging Equities versus Benchmark and Category returns

The chart above shows how Canara Robeco Emerging Equities Fund has been able to beat the benchmark and category return over 1, 3,5 and 10 years period. Beating the benchmark and the category returns even by small margins every year can add up to quite a big out performance to your portfolio and the fund has been able to do so. If you see the performance of this fund vis-à-vis its benchmark, the out performance gap has been very significant over 3, 5 and 10 years period.

Canara Robeco Emerging Equities – Fund overview

Canara Robeco Emerging Equities Fund is suitable for investors with high risk profile, looking for superior capital appreciation for their wealth creation needs. Launched in March 2005, the Canara Robeco Emerging Equities fund has an AUM base of over Rs 1,514 Crores with an expense ratio of 2.36%. Ravi Gopalakrishnan, is managing the fund since 2012 along with Kartik Mehta, who is the co-fund manager since 2016. Ravi Gopalakrishnan has been with Canara Robeco Asset Management since 2012 and is the Head of Equities at Canara Robeco Asset Management Company. Ravi has an excellent track record of fund management across many AMCs.

The fund endeavours to select those companies which fall in the range of the 151st to 500th stock in the listed space by market capitalization and follows a blend of growth and value style investing.

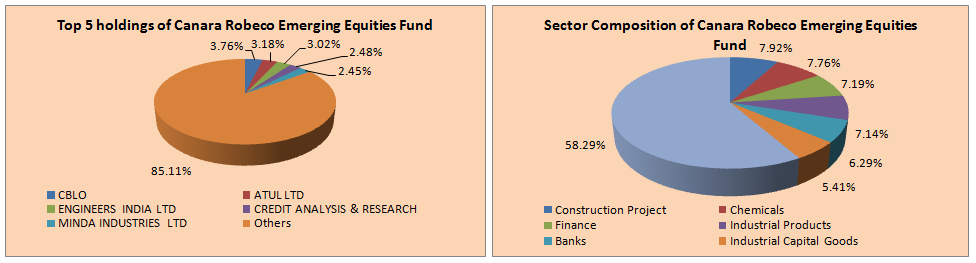

Portfolio construction

The fund selects good quality mid and small cap stocks with strong earnings potential. From a sector perspective, the portfolio has a bias towards cyclical sectors like, Banking & Financial Services, Chemical, Constructions, Engineering and Automobile.

In terms of company concentration, the portfolio is very well diversified with its top 5 holdings – Atul Industries, Minda Industries, Engineers India, CCL Products and Future Retail accounting for only around 14% of the total portfolio. Even the top 10 stock holdings account for only around 25% of the total portfolio value.The fund is well poised to do even better when the capex cycle revives in the Indian economy.

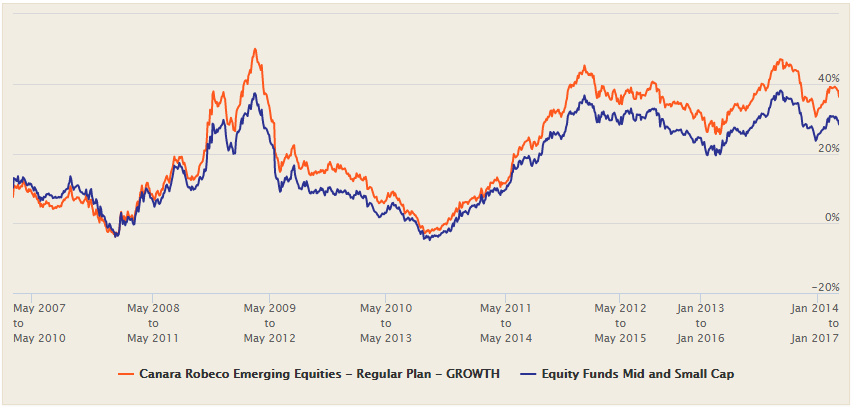

Rolling returns of Canara Robeco Emerging Equities Fund versus Equity Fund Mid & Small Cap Category

The chart below shows the 3 year rolling returns of Canara Robeco Emerging Equities Fund versus the Equity Funds Mid and Small Cap Category. We have taken 3 years rolling return as we feel that investors with minimum of 3-5 years investment horizon should invest in equities.

Source: Advisorkhoj Rolling return Chart

The rolling returns chart of Canara Robeco Emerging Equities Fund versus Equity Funds Mid and Small Cap Category over the last 10 years is a testimony of the consistent performance of this fund relative to its category. You can see that the fund has beaten the category returns almost 90% of the times in the last 10 years. Moreover, you can also observe that, the rolling returns out performance margin of the fund versus the category is quite stable most of the time. This is an evidence of structured fund management approach and prudent risk management practices.

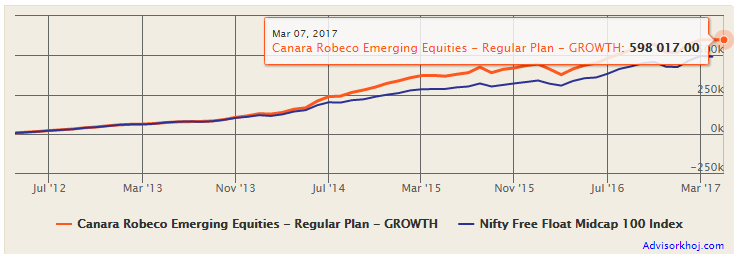

SIP returns of Canara Robeco Emerging Equities Fund Regular Growth

The chart below shows returns as on March 07, 2017 of Rs 5,000 monthly SIP in the Canara Robeco Emerging Equities Fund – Regular option - Growth Plan, in the last 5 years (April 2012 to March 2017). The SIP date has been assumed to be first working day of each month.

Source: Advisorkhoj

The chart above shows that a monthly SIP of Rs 5,000 in Canara Robeco Emerging Equities Fund Growth Plan in the last 5 years would have grown to nearly Rs 5.98 Lakhs, with a total cumulative investment of Rs 3.00 Lakhs only! The SIP return of the fund in the last 5 years has been an amazing 28.72 %( XIRR)!

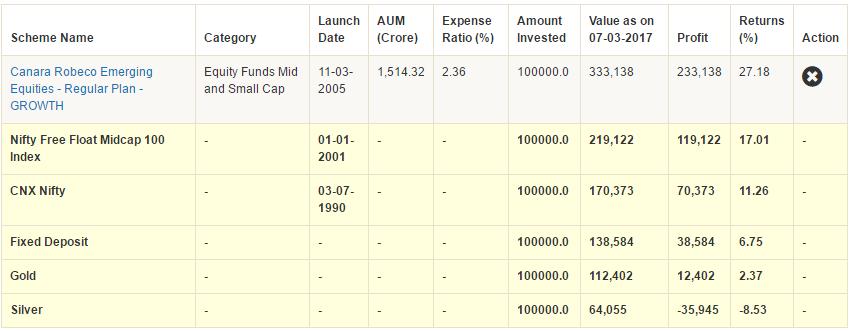

Wealth creation by Canara Robeco Emerging Equities Fund versus other asset classes

The chart below shows that had you invested Rs 1 Lakh in Canara Robeco Emerging Equities Fund Regular - Growth option, your investment would have grown to Rs 3.33 Lakhs – more than 3 times return in 5 years - the fund has delivered 27% returns in the last 5 years (NAV as on March 07, 2017).

Canara Robeco Emerging Equities Fund has also proved how equities as an asset class can deliver the most superior returns over long period of time. As the chart below shows that had you invested the same amount (i.e. Rs 1 Lakh) in NIFTY Free Float Midcap 100 Index or CNX NIFTY or in a fixed deposit, Gold or silver, your investment would have grown only to Rs 2.19 Lakhs, Rs 1.70 Lakhs, Rs 1.38 Lakhs, Rs 1.12 Lakhs or Rs 0.64 Lakhs respectively compared to Rs 3.33 Lakhs delivered by Canara Robeco Emerging Equities Fund – Regular Plan - Growth.

Source: Advisorkhoj Lump sum return Calculator

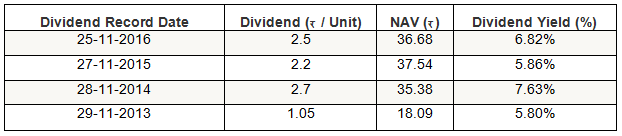

Dividend payment track record of Canara Robeco Emerging Equities Fund Regular – Dividend Plan

Canara Robeco Emerging Equities Fund Regular – Dividend Plan has given 4 annual dividends in the last 5 years.

Conclusion

By delivering 18.14% return (as on March 07, 2017) since launch, Canara Robeco Emerging Equities Fund has established strong long term performance in the last 12 years. The investment approach of this fund has the potential to generate further long term capital appreciation as the capex cycle and Indian economy revives. Investors can consider investing in this fund through the systematic investment plan (SIP) or lump sum route with a long time horizon, provided they can take high risk. Investors with high risk profile and willing to achieve their long term financial goals by investing in equities can consider investing in Canara Robeco Emerging Equities Fund in consultation with their financial advisors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team