How Balanced Mutual Funds created wealth for moderate risk takers

In our previous articles in this series, we had discussed how Systematic Investment Plans (SIPs) in equity mutual funds (large cap, diversified equity, small & midcap and ELSS) have created wealth for the investors. In this article, we will discuss how SIPs in Balanced Funds have also created wealth for the investors in the last 14 years. Balanced funds have been around in India for nearly two decades and good balanced funds have given excellent risk adjusted returns across various time periods. These funds typically have 60 – 70% of the portfolio invested in equities and the rest in fixed income securities. Based on the market conditions your balanced fund manager may rebalance the allocations to debt and equity slightly. SIPs in balanced funds are suitable for investors looking to retire in a few years, or who are investing for some medium term financial objectives. Some of the key benefits of balanced funds are as follows:

- They provide diversification across asset classes, by investing in both fixed income and equities

- A significant portion of the balanced fund portfolio is invested in equities to generate good returns and create wealth for the investors

- Balanced funds have automatic portfolio rebalancing built in due to investment limits set for equity and debt. So in the bull markets, the fund manager sells equity to maintain its maximum level and vice versa. This strategy acts as a buffer against volatility

- As per income tax guidelines, balanced funds that have more than 65% of the portfolio allocated to equities are exempt from long term capital gains tax

In this article, we will discuss how SIPs in Balanced Funds have created wealth for their investors. For our discussion, we have selected 5 Balanced Funds that have given good returns in the last 14 years. This is, by no means, a comprehensive list of all the Balanced Funds that gave good returns in the last 14 years. We should also note here, some of these funds, based on their last 1 to 3 year performance, may not be the top performing funds in this category. This article aims to illustrate how investment in SIPs over a long term, have created wealth for investors in balanced funds, by leveraging the power of compounding. Each of the funds in our selection has created wealth for investors by giving compounded annual SIP returns of over 15% over the last 14 years. Since SIP investments are made over a period of time, the method of calculating SIP returns is different from that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

For our examples, we have assumed a monthly SIP of Rs 3000 only, made on first working day of every month in the Balanced Funds that we will discuss. Let us assume the SIP start date was 14 years back in May 2000. Over this period, the investor would have invested Rs 5.1 lakhs in SIPs of the following balanced funds. Let us see how much wealth would they have accumulated, by investing in the following funds.

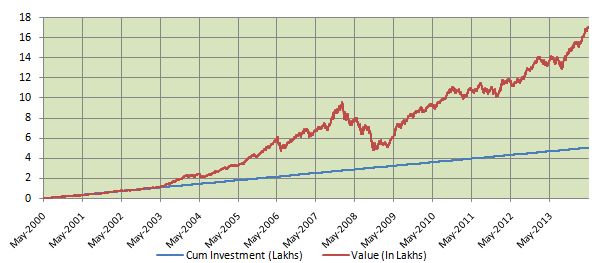

ICICI Prudential Balanced Fund:

The ICICI Prudential Balanced Fund, a hybrid fund from the ICICI Prudential stable, one the best Asset Management Companies in India, was launched in Oct 1999. The fund has an AUM base of over Rs 625 crores and is managed by Yogesh Bhatt and Avnish Jain. The chart below shows the SIP returns of the ICICI Prudential Balanced Fund, growth option, regular plan, over the last 14 years.SBI Magnum Balanced Fund:

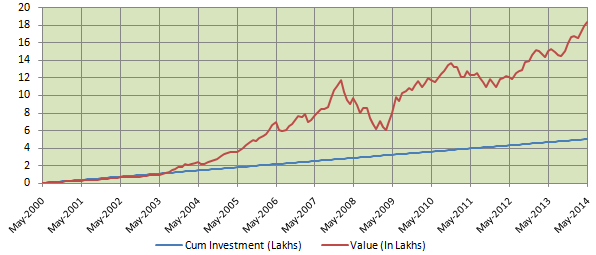

The SBI Magnum Balanced Fund was launched in October 1995 2001. This fund has an AUM base of over Rs 470 crores and is managed by R. Srinivasan and D. Ahuja. The chart below shows the SIP returns of the SBI Magnum Balanced Fund, growth option, over the last 14 years.Birla Sun Life 95:

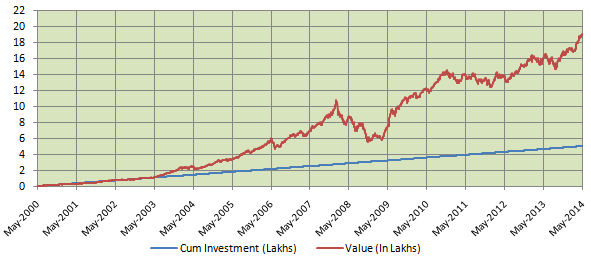

Birla Sun Life 95 fund is one of the earliest balanced funds in India. The fund, from Birla Sun Life stable, was launched in February 1995. This fund has an AUM base of over Rs 630 crores and is managed by Nishit Dholakia and Prasad Donde. The chart below shows the SIP returns of the Birla Sun Life 95 fund, growth option, over the last 14 year.Tata Balanced Fund:

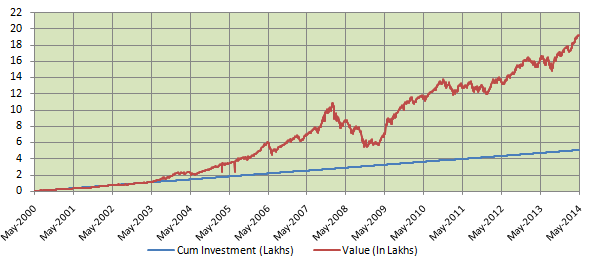

Tata Balanced Fund was launched in October 1995. This fund has an AUM base of over Rs 600 crores and is managed by Atul Bhole and S.Raghupati Acharya. The chart below shows the SIP returns of Tata Balanced Fund, growth option, over the last 14 years.HDFC Prudence:

The HDFC Prudence fund is one of the most popular funds in this category. The fund has given the highest compounded annual returns over the last 10 years, among all balanced funds. This fund was launched in December 1993 and has a large AUM base of over Rs 5000 crores. This fund is managed by Prashant Jain. The chart below shows the SIP returns of the HDFC Prudence fund, growth option, over the last 14 years.

If you had started a monthly SIP of Rs 3000 in ICICI Prudential Balanced Fund back in May 2000, by now you would have accumulated a corpus of over Rs 17 lakhs, with an investment of only Rs 5.1 lakhs. You would have accumulated a corpus of Rs 5 lakhs by the end of 2005 and despite the severe financial crisis in 2008, a corpus of Rs 10 lakhs by the end of 2010. Your investment value would have crossed Rs 15 lakhs by the end of last year. Over the last 14 year period the compounded annual returns on your SIP investment in this fund would be nearly 16%.

If you had started a monthly SIP of Rs 3000 only SBI Magnum Balanced Fund back in May 2000, by now you would have accumulated a corpus of over Rs 18 lakhs, with an investment of only Rs 5.1 lakhs. You would have accumulated a corpus of Rs 5 lakhs by the end of 2005 and a corpus of over Rs 10 lakhs by the end of 2007. Your investment value would have crossed Rs 15 lakhs by the end of 2012. Over the 14 year period from 2000 to 2014, the compounded annual returns on your SIP investment in this fund would be close to 17%.

If you had started a monthly SIP of Rs 3000 only in Birla Sun Life 95 fund back in May 2000, by now you would have accumulated a corpus of nearly Rs 19 lakhs, with an investment of only Rs 5.1 lakhs. You would have accumulated a corpus of Rs 5 lakhs by the end of 2005 and a corpus of Rs 10 lakhs by the end of 2007 / beginning of 2008. You would have crossed the 15 lakhs mark by the end of 2012. Over the 14 year period from 2000 to 2014, the compounded annual returns on your SIP investment in this fund would be 17.3%.

If you had started a monthly SIP of Rs 3000 only in the Tata Balanced Fund back in May 2000, by now you would have accumulated a corpus of over Rs 19 lakhs, with an investment of only Rs 5.1 lakhs. You would have accumulated a corpus of Rs 5 lakhs by the end of 2005 and a corpus of Rs 10 lakhs by the end of 2007 / beginning of 2008. You would have crossed the 15 lakhs mark by the end of 2012. Over the 14 year period from 2000 to 2014, the compounded annual returns on your SIP investment in this fund would be 17.4%.

If you had started a monthly SIP of Rs 3000 only in the HDFC Prudence fund back in May 2000, by now you would have accumulated a corpus of over Rs 26 lakhs, with an investment of only Rs 5.1 lakhs. You would have accumulated a corpus of Rs 5 lakhs by the middle of 2005 and a corpus of Rs 10 lakhs by the middle of 2007 and beginning of 2008. Despite the severe financial crisis in 2008, your corpus in the fund would have crossed the Rs 15 lakhs mark by the end of 2009. You would have crossed the Rs 20 lakhs mark by the end of 2010, and Rs 25 lakhs by end of March this year. Over the 14 year period the compounded annual returns on your SIP investment in this fund would be over 21%.

Analysis of risk

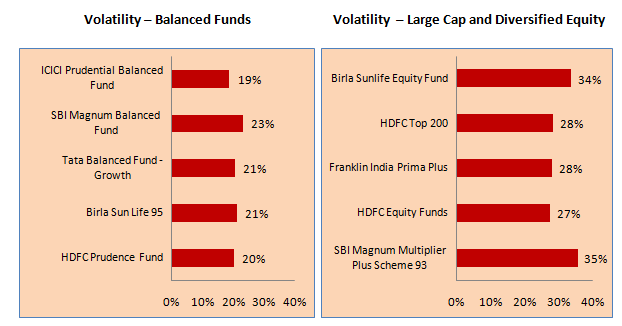

So far in this article, we have seen that balanced funds have also created wealth for the investors. The returns of the balanced fund are a little less than large cap and diversified equity funds (please refer to our article, How Mutual Fund SIPs have created wealth over the last 15 years: Large Cap and Diversified Equity). Both balanced funds and equity funds, like large cap, diversified equity funds and small and midcap funds are equity market linked instruments and are therefore subject to market risks. However, the equity market risk exposure of balanced funds is considerably lower than large cap funds, since 25 – 30% of the balanced fund portfolio is comprised of fixed income securities. Therefore, the volatility of balanced fund investment is significantly lower than equity fund investments. We have compared the risk of balanced funds, discussed above, with some large cap and diversified equity funds (in our article, How Mutual Fund SIPs have created wealth over the last 15 years: Large Cap and Diversified Equity). The risk of a fund is measured in terms of the annualized standard deviation of monthly returns from the fund, over a given time period. For our analysis, we calculated the monthly returns and their annualized standard deviation, for both sets of balanced funds and large cap & diversified equity funds.

The charts below shows the comparison of annualized standard deviation of monthly returns, between balanced funds and the large cap and diversified equity funds over the same time horizon. It is evident that balanced funds are less volatile than equity funds

Conclusion

In this article, we have seen that systematic investment plans in balanced funds have also created wealth for their investors. SIPs benefit from the power of compounding, and therefore the earlier we start our SIPs in funds of our choice, the greater is the potential for wealth creation. If you are an investor with moderate risk tolerance, balanced fund can be a good option for investment. Through a disciplined investing approach you can create wealth and at same time moderate the risk exposure of your investment. To get an objective understanding of your risk profile, you can refer to our article, Measuring Risk Tolerance of Investors, or consult with a financial adviser. Your financial advisers can help you select good balanced funds that are suitable for your risk profile. While selecting a good fund, that is aligned with your risk profile, is a critical success factor for wealth creation, it is equally important that you inculcate a disciplined savings and investment approach. Systematic investment plan is a terrific investment option in that regard, for long term wealth creation.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team