Nifty is now back above 8000: Is it time to be bullish or cautious

Over the past few days 8,200 was a resistance for the Nifty, but that resistance level has been broken and as I write this post, Nifty is trading above 8,200. This level was last seen in October 2015. Those of us, who remained bullish through these months, cannot help but chuckle when we recollect what the prophets of doom told us in the seemingly dark days. These prophets of doom were seen on business channels, predicting how rise in US interest rates would choke off FII funds flow to emerging economies; some were predicting another 30% fall in the index; some were predicting a secular bear market for commodities lasting many years.

However, it is not just on TV where you hear the bearish voices. Some of you may have heard bearish voices when you were having lunch with your colleagues in your office cafeteria, others may have heard in your morning walk group, family functions etc. It is often seen that, alarmists, though they are smaller in numbers compared to the rest of us, have bigger impact on our minds because they make terrifying predictions. If a friend or colleague claims to have heard from well informed sources that the market will fall 30%, it will have a far bigger impact on you than your financial advisor asking you to invest in equities because equity is the best performing asset class in the long term.

Fear is a dominant emotion. However, just like greed, fear makes us take wrong decisions which harm us ultimately. While it is quite difficult to do, if you take greed or fear out of the equation in investment decision making, you will get much better results. The only way to do it is by educating yourself about investments and through prudent financial planning. Coming back to the topic of the day, now that Nifty is above 8,200 some of our readers may be asking themselves, is the bull market back? Will we see 9,000 before end of this year or even Diwali? Or has the last 3 month rally run its course and a big correction is now on the cards? We will discuss some of the questions in our post today.

Market re-bounded from the lows in February

You should remember that, market levels and trends are only relevant in the short term. For a long term investor, asset allocation plays the important role. If you read our blog regularly, you would have observed that we are big fans of systematic investing. However, you can use short term market movements to tactically add equities in your asset allocation. This is where understanding of market movements can be helpful. Further, educating yourself about equity market can, as discussed above, take fear out of investing. In our blog post February 11, Where will the stock market bottom out: A technical perspective, we had discussed why 6,800 was a strong support level for the Nifty.

On Budget day, March 1, the Nifty bottomed out at 6,825. We did not have any crystal ball in front of us which told us that, Nifty will bottom out at 6,800. We relied on technical analysis to determine the support level for the Nifty. We do not claim to have highly specialized technical expertise. If you read our post on February 11, we relied on simple technical indicators like, price reversal patterns, daily moving averages (DMA), trend lines and momentum indicators (like MACD). While these technical terms may sound abstruse to some of you, if you read our February 11 post carefully, you will find these concepts not so difficult to grasp. Even a basic understanding of technical analysis will significantly enhance your grasp of market movements and price levels.

Post Budget Rally

Usually when the market finds its bottom at a strong support level after a big decline, we see a big rally. This is what followed post the budget. We discussed the post budget rally in our blog post shortly after the Union Budget, Understanding the post Budget market rally: Will it be sustainable. In that post we had discussed that, 7500 - 7600 was a key resistance level for the Nifty. If these two resistance levels were broken convincingly on a closing basis one could even see 8,000 on Nifty. Again we would like to emphasize that, we did not make any 8,000 Nifty predications and do not intend to in the future also.

In this series of posts and going forward as well, we will simply rely on technical analysis to get an idea of likelihood weighted possibilities for the market, so that our readers can make the best investment decision for themselves. In the last few days, Nifty has broken the 8,000 level convincingly and is now above 8,200. My personal viewpoint is that, technical analysis can tell you, what next to expect, both on the upside and downside, but one cannot be sure about the precise timing when the expectation would be met. It can take a few days to few weeks to a few months, but for sure it will not take years. Further, one must note that, technical views may change with market movements. Just because I am bullish today, it does not necessarily imply that, I will be bullish next week or even after the next few days. Finally, we would like to re-emphasize that, short term nature of technical patterns. Let us now discuss what we can expect from the Nifty in the coming weeks or months.

What next for the Nifty

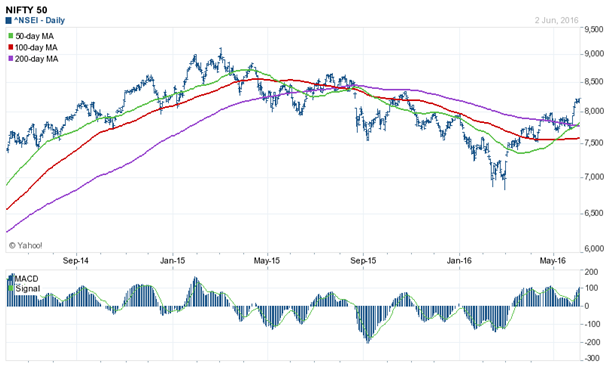

Let us first discuss the market direction. If you have read the previous two technical analysis posts, you will know that DMA is a very useful indicator of market direction. For readers who are not familiar with DMA, as the name suggests, DMA is the daily moving average of the asset prices over a certain rolling period. For example, the 30 DMA of Nifty is the daily moving average of Nifty over the last 30 days. The DMA itself is not as important as its trend is. The trend of 30 DMA will give you the short term direction of the market. The 100 DMA and 200 DMA will give you the longer term direction. The market is bullish in the short term if the 30 DMA is above the 100 DMA and in the moderate term if 100 DMA is above the 200 DMA. Let us now look at the 2 year price chart of Nifty.

Source: Yahoo Finance

Firstly, you can clearly see that, the market found its bottom below 7,000 and is now on an upward trend. Let us now discuss DMAs. If you read our previous two posts, you would have observed that the 50 DMA was below the 100 DMA, which in turn was below 200 DMA. This was a bearish indicator. However, now things have changed. You can see in the chart above that, the 50 DMA crossed the 100 DMA in May and very recently crossed even the 200 DMA (observe the extreme right end of the chart). Also, observe that the 100 DMA and the 200 DMA are slowly moving towards each other.

Make no mistake; this is a bullish indicator. Short selling might be risky in this market. Even if you short on an intraday or overnight basis, you should have strict stop losses. Further, investors who are sitting on cash and waiting for a big correction might not get one, deep enough and therefore, should buy on every dip instead of waiting. Finally mutual fund investors, who invested in liquid funds and were investing in equity funds through systematic transfer plans to take advantage of market volatility, should now re-think their approach.

By how much can Nifty go up or down in the near term

To answer that question, we have to look at the resistance and support levels. Investors and traders should remember two important points, with regards to resistance and support levels. We had discussed these two points in our previous two posts. Firstly, price reversal points act as resistance and support levels. Secondly, a strong resistance becomes a strong support, when market moves up and vice versa. Let us first discuss the next strong resistance for Nifty, by referring again to the 2 year price chart.

Source: Yahoo Finance

Please focus your attention on the three dotted lines in the chart above. These three lines represent multiple price reversal points in the last 2 years. Therefore, they will act as resistance levels. The lowest line is where Nifty is today, in the range of 8,200 to 8,500. The next resistance level is at around 8,400 and the third resistance level is at around 8,700. Let us now discuss, the likelihood of these resistance levels being breached. Let us now see what the support level for Nifty is.

Source: Yahoo Finance

Look at the dotted line. Nifty reversed from this level a number of times. Therefore, it was a strong resistance level. But when a strong resistance level is breached, it becomes a strong support. Therefore, Nifty will have strong support at 8,000. In the last 2 weeks Nifty has rallied over 5%, so it is only natural that we will see some profit booking in the coming days. Investors can use these dips to tactically increase the asset allocation to equities.

Should you bullish or cautious

As discussed earlier, the DMA crossovers (50 DMA crossed the 100 and 200 DMAs) signalled bullishness in the market. Nifty crossed over its 200 DMA in May. In the world of technical analysis, the market crossing over its 200 DMA is usually considered to be a big deal. Let us now look at another important technical indicator known as MACD (we discussed the concept MACD in our post, Where will the stock market bottom out: A technical perspective). For readers, who are not familiar with MACD, suffices to say that, in very simple terms, MACD is a momentum indicator. It is typically shown as a histogram in the bottom portion of the most technical charts (you can find technical charts of Nifty and stocks on Yahoo Finance and many other finance websites). MACD oscillates above and below the zero line. Positive MACD means upside momentum is increasing, which negative MACD means downside momentum is increasing.

Source: Yahoo Finance

Focus your attention on the histogram at the bottom of the chart. You can see that the MACD crossed in positive territory in March, which indicated bullish momentum. The momentum has only strengthened. Therefore, based on these simple technical indicators, we can infer that there is bullishness in the market. However, should you throw caution to winds? In my opinion, while technical analysis is a useful tool for getting a sense of future market direction and levels, smart investors should always keep an eye on important upcoming events which can have significant impact on the market. By significant impact, I mean that, these events by themselves can have the power to breach important technical levels for the Nifty.

There are two important upcoming global events. The first important event is the US Fed rate hike. That one or two rate hikes will happen this year is a given, since Federal Reserve chairman, Janet Yellen, has clearly spoken about. Since the market knows that the rate hike will happen it will start (or may have already) discounting it in prices. It is the timing of the rate hike that will have a bigger impact on the price levels. Some market analysts are predicting two rate hikes to take place in the summer itself, which in turn can have a fairly adverse impact on the equities. However, likelihood of rate hike this month (when Fed meets on June 14) has receded because of poor jobs data in the US and the possibility that the Fed may wait for the outcome of the other important global event, which will discuss next.

The other important global event will take place later this month (June 23), when Great Britain will vote on whether to stay in the European Union. If Britain decides to leave European Union, it is likely to cause turmoil in financial market, and will definitely have a big impact on equities globally and here in India. In fact, Brexit (Britain’s exit from EU) may have bigger impact on the market than the Fed rate hike. Therefore, while the technical charts are bullish, there is need to exercise caution as we approach these two events.

Conclusion

In the last 3 months Nifty has risen more than 20%. The technical indicators, discussed in today’s post, indicate bullishness in the market. The bullishness may continue in the coming weeks, but as we approach end of June, we should be cautious. Cautiousness does not imply risk aversion, it simply means that we should exercise prudence and make decisions based on risk return trade-off. Finally, if you are a long term investor, a big correction is not a bad thing; it is actually an investment opportunity.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team