Principal Emerging Bluechip Fund: One of the best large and midcap funds

One of the biggest benefits of SEBI’s Mutual Fund Scheme re-classification initiative is that, investors now have a clearer idea about the market cap composition and risk characteristics of a mutual fund scheme.

Large and midcap mutual fund category by definition must have at least 35% investment in large cap stocks and at least 35% investment in midcap stocks. Large cap stocks as per SEBI’s definition are the 100 largest companies by market capitalization. Midcap stocks as per SEBI’s definition are the next (after 100 large cap stocks) 150 largest companies by market capitalization. Previously, large and midcap funds were either classified as diversified funds or flexi-cap funds or midcap funds. Such categorization was often misleading; large and midcap mutual funds combine the risk characteristics of both large and midcap segments.

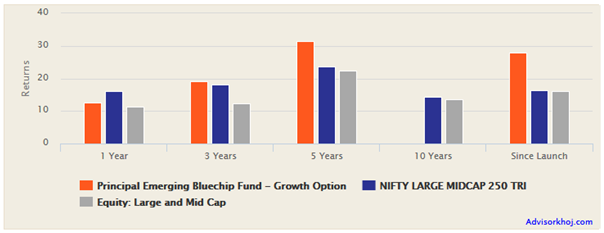

Within the large and midcap mutual fund category, the Principal Emerging Bluechip Fund has been one of the top performers over the last 5 years (see Top Performing Large and Midcap Funds). It has consistently beaten large and midcap mutual funds category over different time periods. The chart below shows the returns of the Principal Emerging Bluechip Fund versus its benchmark and large& midcap mutual fund categories, over different trailing periods (ending August 26, 2018).

Source: Advisorkhoj Research

Fund Overview

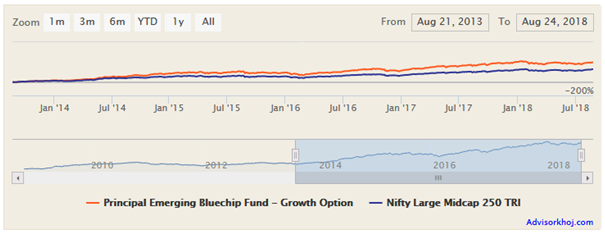

The Principal Emerging Bluechip Fund was launched in the depths of the financial crisis in October 2008 and has given 28% CAGR returns to its investors since its inception. The fund has just crossed Rs 2,000 Crores of assets under management (AUM). The expense ratio of the fund is 2.4%. The fund manager of this scheme is Dhimant Shah. The chart below shows the NAV growth of the fund over the last 5 years.

Source: Advisorkhoj Research

Principal Emerging Bluechip Fund is suitable for investors planning to make investments for long term financial goals, like retirement planning, children’s education, wealth creation etc. The fund is open for both growth and dividend options.

Consistency of annual returns

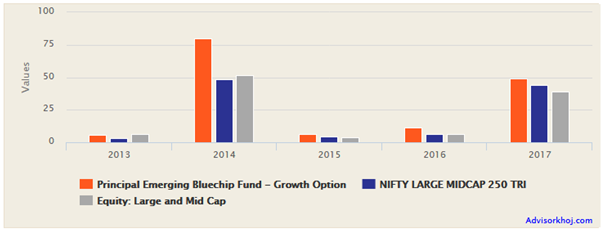

The fund consistently outperformed both the benchmark and the large & midcap funds category in the last 5 years.

Source: Advisorkhoj Research

Principal Emerging Bluechip Fund was consistently in the top 2 quartile performance in the last 4 years and in the top quartile in 3 out of the last 4 years. Accordingly, it is one of the most consistent performers in the large and midcap funds category (please see our research section, Top Consistent Mutual Funds).

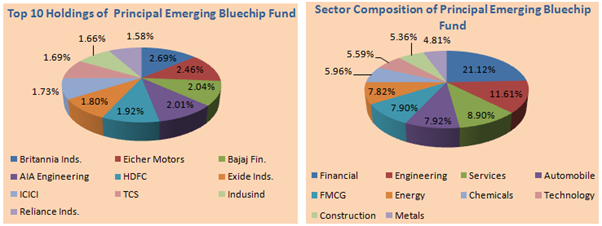

Portfolio Composition

The fund currently has a midcap bias. The scheme investment style is growth at a reasonableprice (GARP) and is currently focused defensively. Banking and financial services, engineering, services, automobiles, FMCG and energy are the major sectors in the portfolio. The fund is well diversified from a company concentration standpoint.

Source: Advisorkhoj Research

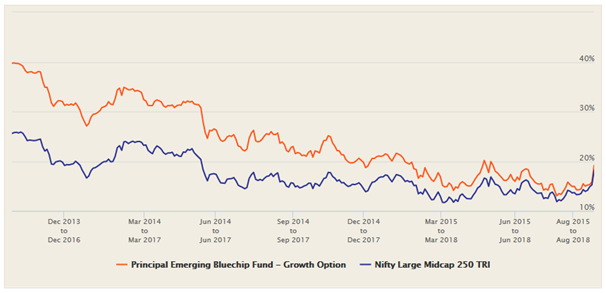

Rolling Returns

The chart below shows the 3 year rolling returns of Principal Emerging Bluechip over the last 5 years versus its benchmark, Nifty Large Midcap 250 TRI. You can see that the fund has consistently beaten its benchmark.

Source: Advisorkhoj Research

The chart below shows the 3 year rolling returns of Principal Emerging Bluechip Fund over the last 5 years versus the Large and Midcap funds category. You can see that the fund has consistently beaten its benchmark.

Source: Advisorkhoj Research

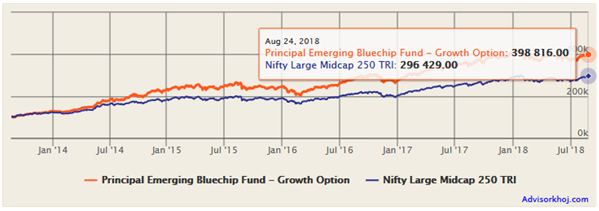

Lump Sum and SIP Returns

Rs 1 lakh lump sum investment in the fund (growth option) would have grown to nearly Rs 4 lakhs in the last 5 years (see the chart below). The CAGR returns over the last 5 years were a whopping 32%!

Source: Advisorkhoj Research

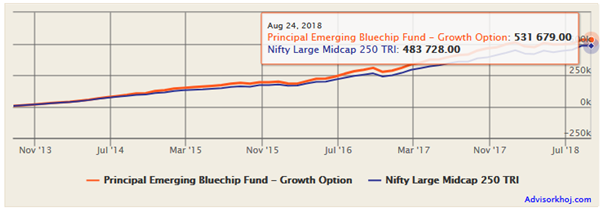

The chart below shows the returns of Rs 5,000 monthly SIP in the fund (growth option) over the last 5 years. With a cumulative investment of Rs 3 lakhs, you could have accumulated a corpus of Rs 5.3 lakhs. The monthly SIP XIRR over the last 5 years was 22.24%.

Source: Advisorkhoj Research

The SIP returns of the Principal Emerging Bluechip fund is a testimony of the benefits of systematic investing (SIP). The investors who continue to make systematic investments through bear and bull market cycles get excellent returns.

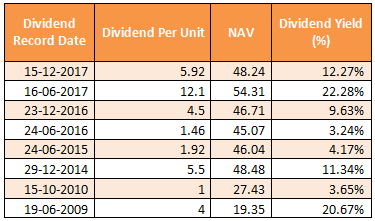

Dividend Pay-out Track Record

The scheme has a good dividend pay-out track record over the last few years; the scheme has paid half yearly dividends in 2016 and 2017.

Source: Advisorkhoj Research

Conclusion

The Principal Emerging Bluechip fund (growth option) has nearly 8 years of strong performance. This fund is suitable to investors who have a long time investment horizon. Investors should note that large and midcap mutual funds are intrinsically more risky than large cap mutual funds; they can underperform in volatile markets. In the long run however, large and midcap mutual funds have the potential to give high returns. Investors should have long investment tenors, ideally 5 years or more, so that they can get the best results out of their investment in this category of funds. Onecan consider investing in the schemeboth through the systematic investment plan (SIP) or lump sum route.If you are expecting volatility to continue this year, going into next year, then you can also invest through a 3 to 6 months systematic transfer plan (STP) from a liquid fund. Investors should consult with their financial advisors, if Principal Emerging Bluechip fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team