AXIS Small Cap Fund: A good fund to invest in for the long term

Post the COVID-19 2020 market crash, small cap funds emerged strongly and outperformed in 3 out of the 4 years since then. With the exception of 2022 small cap funds as a category has beaten returns of large cap and mid cap category. After the correction in 2022, the year 2023 saw a huge influx of investors’ money in the small cap funds. As per AMFI monthly data, small cap funds have received the largest inflows among all equity fund categories in FY 2023 – 24 with Rs 34,103.29 crores of net inflows as at December end. In the same year, till December 2023, the Nifty 250 Small cap TRI gave a return of 49.09%. (Source: NSE, as on 31st Dec 2023)

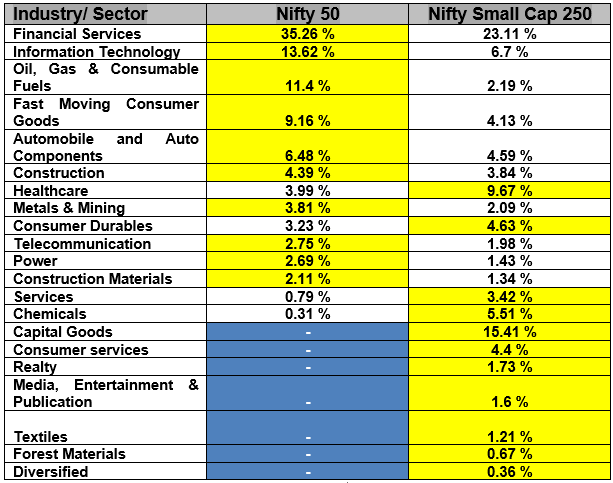

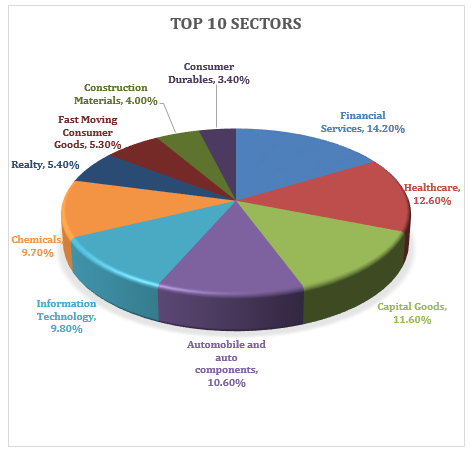

Broader Industry exposure through Small Caps

Small Cap funds have a broader exposure to different sectors. Nifty 50, representing the large caps, on the other hand have a narrower exposure to market sectors. Sectors that may contribute to the market growth in India may not be represented on the Nifty 50. (See the chart)

Source: NSE (As on 31st Dec 2023)

Larger universe of stocks

Small cap sphere of stocks is much bigger than either mid-caps or large caps. Small cap features 537 stocks above the market cap of Rs 2,000 crores. This large universe of stocks provides greater opportunities for the creation of alpha. This is because the fund manager may be able to identify stock with significant growth prospects.

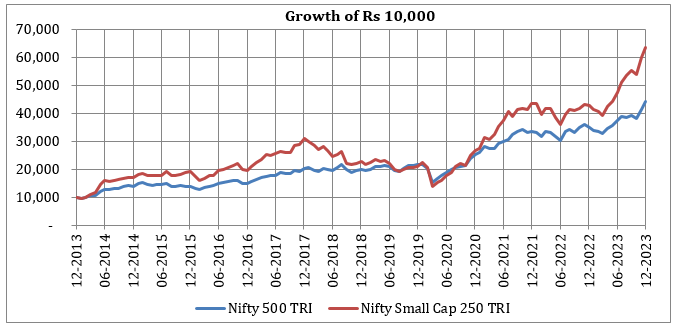

Performance of Small Caps

Small caps have outperformed the broader markets. Observe the growth of Rs 10,000/- lumpsum investment in the Nifty 250 small cap TRI over the last 10 years compared to the returns of the broad market index Nifty 500 TRI. Notice that the small cap has mostly outperformed the broad market index returns by a wide margin. NIFTY 250 Small Cap TRI has given 20.77% CAGR returns compared to NIFTY 500 TRI which gave 16.22% CAGR returns in the last 10 years.

Source: Advisorkhoj Research. (Data as on 1st January 2023)

Why should you invest in Small Cap Funds now?

We will now look at the Axis Small Cap Fund (Regular Growth) as an investment option in this category.

About Axis Small Cap Fund Regular Growth

The inception date of the open-ended scheme Axis Small Cap Fund is 29th November 2013. Since inception, it has given a CAGR of 23.73% compared to the benchmark returns of 16.73%. The expense ratio of the growth option is 1.65% (as on 31st December 2023). The Assets under Management of the fund as on 31st Dec 2023 stood at Rs 18,615.72 Cr. The NAV of the scheme stood at Rs 86.90 as on 21st January 2024. The scheme seeks to generate long term capital appreciation through investment predominantly into equity and equity related securities in the small cap space. The fund is managed by the experienced team of fund managers Shreyash Devalkar, Mayank Hyanki & Vinayak Jayanath (Foreign securities)

Performance of Axis Small Cap Fund

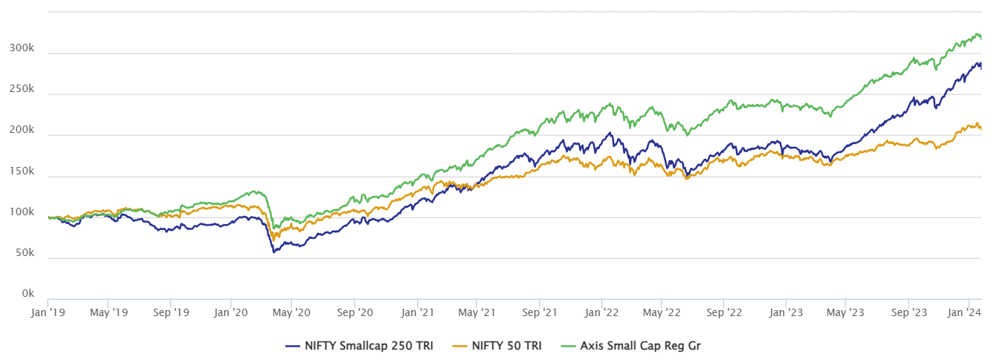

A lumpsum investment of Rs 1,00,000/- into the Axis Small Cap Fund on 1st January 2019 would have grown to Rs 317,075/- as on 24st January 2024 giving a CAGR return of 25.6%. During this period the returns from Axis Small Cap consistently outperformed the benchmark Nifty Small Cap 250 TRI as well as Nifty 50 TRI. (See the chart below -Source: www.advisorkhoj.com)

Disclaimer: past performance may not be indicative of future performance.

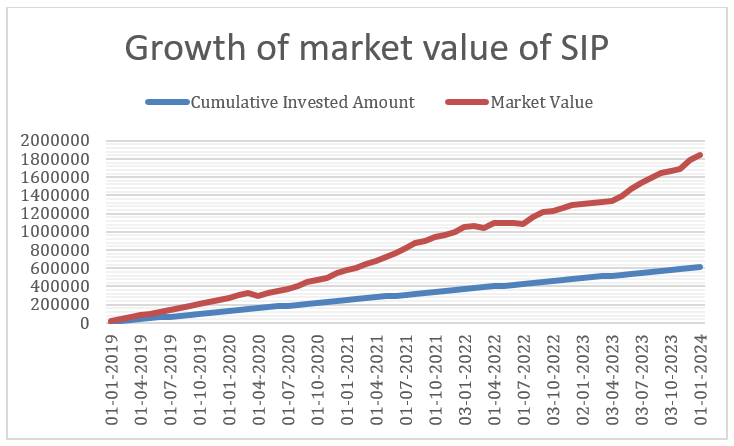

A monthly SIP of Rs 10,000/- started on 1st January 2019, in the Axis Small Cap fund would have grown to Rs 12,30,839/- till date (24th January 2024) against an investment of Rs 6,10,000/- giving an XIRR of 28.2 %.

(Source: Advisorkhoj research. Disclaimer: past performance may not be indicative of future performance)

Investment strategy of the Axis Small Cap Fund

- Bottoms up investment approach.

- Aim to generate alpha with diversified portfolio of stocks.

- Portfolio built keeping in mind the risk and reward by containing risks and navigating volatile stock movements.

Portfolio Allocation of AXIS Smallcap Fund (as on 31st December 2023)

Source: Axis Mutual Fund Factsheet (as on December 2023)

(Source: Axis Mutual Fund Factsheet as on December 2023).

Why should you invest in Axis Small Cap Fund?

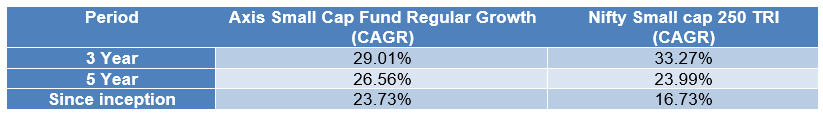

Returns Analysis -

The table below shows the returns of the Axis Small Cap Fund compared to the performance of its benchmark Nifty Small Cap 250 TRI. It can be seen that except in the 3-year period, the fund has performed better than its benchmark. It should be noted that for the Small Cap category, the investors should be invested for at least 5 years to reap a favorable return.

Source: www.advisorkhoj.com Research (as on 23 January 2024) Disclaimer: Past performance may or may not be repeated in future.

Rolling Return -

The chart below shows the 3 year rolling returns of the Axis Small Cap Fund since inception. You can see that the fund has been able to outperform the benchmark most of the times pre-COVID. The returns were low during the COVID times. However, the fund still gave an average return of 19.70% compared to the average returns of 14.94% given by Nifty Small Cap 250 TRI.

Source: AdvisorKhoj Research (as on 23 January 2024)

The Axis Mutual Fund Advantage

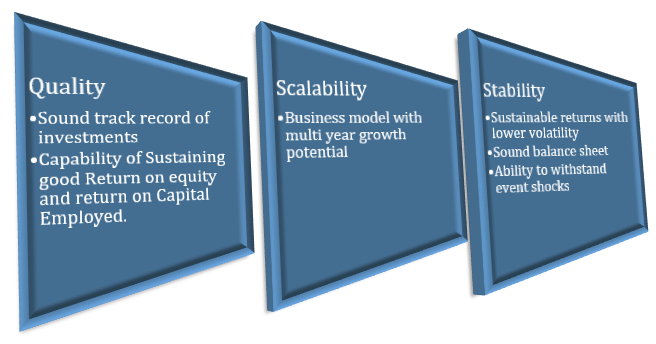

The Axis MF operates on the principle of Quality, Scalability and Stability to aim to beat the benchmark.

Source: Axis Mutual Fund

Who should invest in Axis Small Cap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with minimum 5 years investment tenures.

- Investors with very high-risk appetites.

Investors should consult with their financial advisors or mutual fund distributors if Axis Small Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Aditya Birla Sun Life Mutual Fund launches Aditya Birla Sun Life Fixed Term Plan Series UU: 98 Days

Apr 30, 2024 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Manufacturing Fund

Apr 26, 2024 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Nifty Alpha Low Volatility 30 Index Fund

Apr 26, 2024 by Advisorkhoj Team

-

Kotak Mutual Fund launches Kotak FMP Series 330

Apr 25, 2024 by Advisorkhoj Team

-

Groww receives SEBI approval to launch Indias first Nifty Non-Cyclical Consumer Index Fund

Apr 24, 2024 by Groww Mutual Fund