Small Savings Schemes Interest Rates will fall further: What should investors do

Interest rate cuts by the Reserve Bank of India (RBI) are usually good for the economy. It reduces the borrowing costs of business, which in turn leads to incremental economic activity, higher employment rates and higher GDP growth. The stock and bond markets react favourably to rate cuts by the RBI. On April 5, 2016 the RBI cut the repo rate by 25 basis points and on the same day the Sensex fell by more than 500 points, because the market was expecting a bigger cut. Whether there is room for RBI to reduce rates further in the coming quarters is a topic of debate amongst economists, bankers and policy makers. While lower interest rates are good for the stock and bond markets, as a society we should also recognize that there are millions of Indians who depend on the interest income of small savings schemes.

Small savings schemes formed 35% of the financial savings of average Indian households from FY 2000 – 2014. In the month of February 2016, the Government announced new small savings scheme rules, which has come into effect from April 1, 2016. Under the new rules, investors in small savings schemes like Public Provident Fund, National Savings Certificates, Senior Citizens Savings Scheme, Post Office Monthly Income Scheme, etc will earn considerably lower income than before. Further, under the new rules, the interest is likely to fall further in the future. What should investors who depend on these schemes do? In Advisorkhoj, we believe in the old adage, “Knowledge is power”. While situations in life change, your knowledge remains with you. Knowledge does not only help you understand the current situation but, more importantly, it arms you with the power of foresight, which helps you to make better financial decisions. In this blog post, we will discuss what has changed in the small savings schemes, why has it changed, what may happen with interest rates in the future and finally, how can you increase your income?

New Small Savings Rules

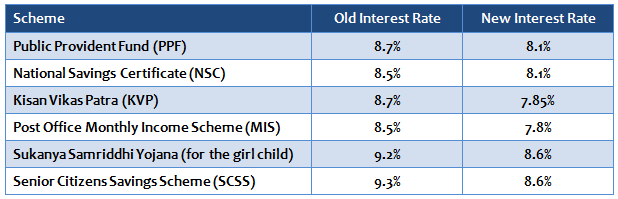

From April 1, 2016 the interest rates of small savings schemes have been revised downwards. The table below shows the revised interest rates, with effect from April 1, 2016.

Source: New interest rates as per India Post website

While the lower interest rates will certainly hurt the income of investors in these schemes, this is not the only change in small savings schemes. Earlier, the interest rates were set for one year. Under the new rules, the interest rates will be revised every quarter, based on the previous 3 month yields of the benchmark Government Bonds with a small mark up. Under the new rules, even the quantum of mark up has been reduced. So if Government Bond yields fall by 20 basis points in the first quarter of this year, the interest rates of small savings schemes can go down further by 0.2% in the next quarter. This is an important point that you should remember for your financial planning.

Why were these changes introduced?

While most of these changes were expected over the last few months, there were expectations in some quarters that the Government would leave the Senior Citizen Savings Scheme and Sukanya Samriddhi Scheme interest rates unchanged, since senior citizens and girl children are two important demographic constituencies in India. However, you can see that, the interest rates of even these two schemes were slashed. Let us understand why the interest rates of small savings schemes were reduced by the Government. Since 2015, the RBI has reduced repo rates by 1.25%. However, reduction in policy rates did not translate into an equal reduction of actual lending rates by the banks. While the RBI cut interest rates by 1.25%, only about 60% of the rate cut was passed on to the borrowers by the banks. As such, the RBI rate cuts did not have the desired effect on credit off-take and economic growth in India.

The banks cited multiple reasons as to why they were not able to reduce their lending rates by the same quantum as the RBI rate cut. The reasons why banks were not able to cut lending rates by as much as the repo rate reduction are not part of our discussion today. The RBI has already taken steps to ensure better transmission of monetary policy actions, e.g. new method of calculating base lending rates, lowering cash reserve ratio (CRR) requirements etc. Relevant to today’s topic, is one of the reasons, the banks cited for the transmission gap with respect to monetary policy actions of the RBI. The banks said that they were not able to reduce their deposit rates, because they were facing unfair competition from the small savings schemes of the Government. Since the interest rates of the Government small savings schemes were high and some of these schemes also enjoyed favourable tax treatment, the banks were not able to bring down their deposit rates to the desired extent because they were losing their share of Indian household savings to the Government small savings schemes.

The high percentage of house financial savings in small savings schemes over the last 15 years, as discussed in the first paragraph of this post, lends credence to the bank’s argument. Since the banks were not able to reduce their deposit rates to the desired extent, they were also not able to reduce the lending rate. On this premise, the RBI has been asking the Government to reduce the interest rates in the small savings scheme so that the banks can reduce their fixed deposit interest rates, which will result in lower cost of funds for the banks, which in turn will enable them to reduce lending rates. The Government saw merit in RBI’s position and reduced the interest rates of the small savings schemes. Further, the Government felt that the interest rates of small savings schemes were not linked to yields of Government bonds to the extent they should be. Investors should understand that, the collections in the small savings schemes are invested in Government bonds of different maturities. While the yields of the Government bonds are market driven, the interest rates of small savings schemes were set for a year and sometimes remained unchanged for years together. The quarterly reset of interest rates of these small savings is a measure to bring about a greater alignment between market yields and small savings interest rates.

What may happen with small savings scheme’s interest rates in the future?

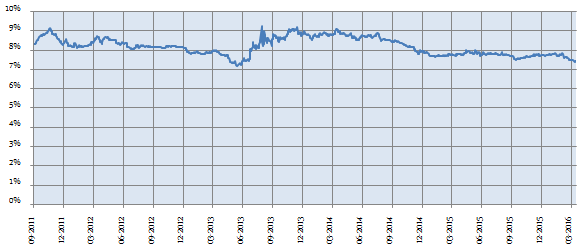

Under the new rules, interest rates of small savings schemes in the next quarter and beyond will depend on the benchmark Government bond yields. On April 5, the RBI reduced repo rates by 25 bps. We had discussed earlier that the RBI was also taking steps to improve the transmission of rate cuts in the banking system. In their April 5 monetary policy announcement, the RBI announced significant measures to improve the liquidity situation in the banking system of India. You should also remember that from April 1 2016, the banks have adopted a new method, prescribed by the RBI, for calculating base lending rates, which will be based on marginal cost of funds of the banks. SBI and ICICI Bank have already come out with revised lending rates, based on the new method. The effect of all the measures taken by the RBI, as per bankers and economists, will result in lower actual interest rates in the economy and lower Government bond yields by 20 to 25 basis points further. If the benchmark Government bond yields fall by 20 to 25 basis points, the interest rates of small savings schemes will fall by a similar amount. What is the longer term outlook of Government Bond yields? The chart below shows the historical 10 year Government bond yields.

Source: Investing.com

You can see in the chart above that, 10 year Government Bond yield has been declining from its high of around 9% over the last 2 years. The 10 year Government Bond yield is now well below 8%. In fact, if you carefully observe the last part of the chart, you will see that the 10 year yield has come down in the last one month. The Government is targeting a lower year on year fiscal deficit in FY 2017. CPI inflation is in control aided by lower global commodity prices. We had two consecutive bad monsoons in India. Very early meteorological forecasts indicate good monsoon this year; better meteorological forecasts will be available in the next few weeks. Our point is that, if we have good monsoon, the food price inflation will be lower. The RBI has reiterated its accommodative monetary policy stance in each of its policy announcements over the last few quarters. Therefore, one can expect the Government bond yields to go down further in the coming quarters, barring unexpected economic shocks. As a result, the interest rates of small savings schemes are likely to go down further, in the near to medium term with reduction in Government Bond yields.

What should investors do?

Though the reduction in small savings scheme’s interest rates will hurt many Indian households who depend on these schemes, investors simply have no choice but to accept the new reality. As discussed in the previous paragraph, the interest rates of small savings schemes are likely to go down further over the coming quarters and also years. About 4 months back, a relative from my wife’s side, who will retire in April 2017, told me that he would invest a substantial portion of his Provident Fund and Life Insurance policies maturity proceeds in the post office MIS and earn 8.5% interest, payable monthly, for a significant part of his post retirement monthly income needs. Naturally, he is worried after the MIS interest rates were slashed by 0.7%. Worrying will not help you; you have to invest wisely to get the best possible income from your investment. Here are some of the options that you can consider to get a higher income.

- Despite the reduction in interest rates, Senior Citizens Savings Scheme and Sukanya Samriddhi Yojana are still good investment options for the respective demographic profiles.

- Many large banks are still paying around 7.9 to 8% interest on 1 to 2 year fixed deposits. This is higher than the interest paid by some small savings schemes. While bank fixed deposit interest is taxed as per the income tax rate of the investors, some of the small savings scheme’s interest incomes are also fully taxable, e.g. post office MIS, Kisan Vikas Patra etc. Therefore, if you want to lock in higher interest rates in fixed deposits, you should ensure that you invest before the banks reduce their FD rates.

- One big disadvantage of fixed deposits is the tax treatment. Interest earned in fixed deposit is fully taxable. This is an aspect where debt mutual funds are much better investment options over a 3 year or more investment horizon. If you expect interest rates to go down in the future and want to lock in higher yields, along with beneficial tax treatment over an investment horizon of 3 years or more, Fixed Maturity Plans (FMPs) are good investment options. If you see bank fixed deposit rates, you will observe that the two to three year FD rates are lower than the one to two year FD rates. By investing in FMPs, you can reduce your interest risk and earn highly tax efficient income over a three year investment horizon. FMPs invest in fixed income securities where the maturities match with the maturity of the scheme and therefore the interest rate risk is very low. The three year Government bond yield is about 7.3% and you can get a credit spread (higher interest rate) of 1 to 2% in FMPs which invest in slightly lower rated papers (corporate bonds). Therefore, the pre-tax returns of these FMPs are likely to be higher than bank fixed deposits and most small savings schemes. In terms of post tax returns, FMPs enjoy a major tax advantage. Over a 3 year term or more, debt mutual funds are taxed at 20% with indexation. We have discussed the tax benefits which debt mutual funds enjoy in our blog post, SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits. We regularly share with our readers, the upcoming New Fund Offers (NFO) in our News section. Please follow us and you may be able to identify NFOs, including FMPs, which are suitable for your investment needs.

- Investors who are familiar with mutual funds may know that, FMPs had been very popular products in the last 5 to 6 years for investors who wanted to get higher stable returns along with tax benefits. However, you should know that FMPs are close ended mutual fund schemes, which implies that, you cannot withdraw your money before the maturity term of the scheme. For tax reasons the maturity term of most FMPs are more than 36 months now. However, if you want to have the option of redeeming your investment at any point of time, open ended debt mutual funds are also good investment options. Risk-averse investors can invest in accrual based short term debt funds. These funds have very limited interest rate risks. Top performing short term debt funds have given 9 to 10% returns in the last one year (please see our MF Research section). The returns of the top short term debt funds were higher on a pre-tax basis than that of many small savings schemes, even under the old small savings interest rate regime. If interest rates and bond yield declines, then short term debt funds cannot be expected to give such high returns in the future, but the interest rates of small savings schemes will also decline under the new rules of quarterly reset. If you factor in the tax benefits that debt mutual funds enjoy over a three year or more investment horizon, accrual based short term debt funds are indeed good investment options for conservative investors. If you want to get slightly higher returns, then credit opportunities funds are also good investment options. These funds are very similar to short term debt funds and are sometimes treated as a sub-category of short term debt funds. These funds invest in slightly lower rated corporate papers to capture higher yields.

- When interest rates and Government bond yields go down, the interest rates of the small savings schemes also go down on a quarterly basis. On the other hand, when interest rates are lower, long maturity bond investors get higher returns from the capital appreciation of bonds. When interest rates decline, bond prices increase. Income funds invest in a variety of fixed income securities such as bonds, debentures and government securities, across different maturity profiles. The average modified duration of securities in the portfolio of income funds can be 7 years or even more. If duration of income fund portfolio is 7 years and yields fall by 1%, the price of the bonds in the income fund portfolio can increase by 7% or more. The capital appreciation is over and above, the yield earned by the fund through coupon (interest) payments of the bonds in its portfolio. Therefore, if the yield to maturity of an income fund is 8% and interest rate declines by 0.5% during a year, the fund can give 11.5% returns before deduction of expenses. If the expense ratio of the fund in our example is less than 1.5%, then fund can give double digit in such a scenario. Over a long investment horizon of three years or more, income funds are excellent investment choices for investors, who can take some interest rate risk and have a sufficiently long investment horizon. Over the past 3 years, top performing income funds have given 9.5 – 12% annualized returns (please see our MF Research section). As discussed earlier, the tax advantage of debt mutual funds over a period of 3 years or more makes these funds even more attractive for investors.

Conclusion

In this post, we have discussed that, the interest rates of small savings schemes have been slashed, starting April 1, 2016. It is very likely that, the interest rates will be reduced further in the coming quarters. Investors have no choice but to accept the new reality with respect to these schemes. On the other hand, if investors educate themselves about different products available, especially in the mutual fund space (please see our article, Demystifying debt mutual funds), they can get good tax efficient returns which will meet their financial goals.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team