Decoding 2014 Budget: Implications on Savings and Investments

The Finance Minister announced some important changes to the personal income tax front in the 2014 Budget. We will discuss these changes and the implications for tax payers in this blog.

Basic exemption limit:

The basic exemption limit of personal income tax has been increased by Rs 50,000. The previous basic exemption limit was Rs 2 lakhs. The Finance Minister has raised this limit to Rs 2.5 lakhs. In the previous regime the tax rate for Rs 2 lakhs to 5 lakhs slab was 10%. Raising the basic exemption limit by Rs 50,000 will result is an annual tax saving of Rs 5,000 for the tax payer. For senior citizens, the basic exemption limit has been increased from Rs 2.5 lakhs to Rs 3 lakhs, resulting in annual tax saving of Rs 5,000 for seniors also.

To summarize, the income tax rates for individuals and Hindu Undivided Families are as follows:-

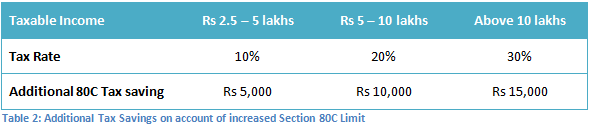

Section 80C Limit:

The Section 80C limit of eligible deductions from taxable income has been raised from Rs 1 lakh to Rs 1.5 lakhs. This gives a further tax saving of Rs 5,000 to Rs 15,000 to tax payers, depending on their tax brackets, if they are able to invest additional Rs 50,000 towards the increased limit of Rs 1.5 lakhs of 80C investments. These investments include, employee provident fund, voluntary provident fund, public provident fund, life insurance premiums, equity linked savings schemes (ELSS), National Pension Scheme, Post Office Time Deposit, home loan principal repayment etc. The table below shows the additional tax saving for tax payers in different income and tax brackets.

Maximum PPF Deposit

The maximum deposit limit in PPF (Public Provident Fund) per annum has been raised by Rs 50,000 from Rs 1 lakh to Rs 1.5 lakhs, in line with the increase in Section 80C limits. If the tax payer is able to deposit additional Rs 50,000 towards PPF every year not only we will he or she get Rs 5,000 to Rs 15,000 of additional tax savings under Section 80C, but over a 15 year period will be able to generate an additional corpus of Rs 14.33 lakhs at the current rate of interest of 8.7%.Limit of deduction for interest paid on housing loan:

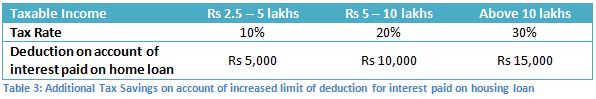

The Finance Minister has also raised the limit of deduction for interest paid on housing loan under Section 24 of the Income Tax Act by Rs 50,000. In the previous tax regime, the maximum deduction on account of interest paid on home loan, for a self occupied property was Rs 1.5 lakhs per annum. In this budget, the maximum deduction on account of interest paid on home loan, for a self occupied property has been raised to Rs 2 lakhs per annum. This will result in further tax savings of Rs 5,000 to Rs 15,000 to tax payers, depending on their tax brackets, if the annual interest payment in their home loan EMIs is Rs 2 lakhs or above. Please note that this is over and above the tax saving for home loan principal repayment under Section 80C. The table below shows the additional tax saving for tax payers in different income and tax brackets.

Capital Gains Tax:

Two important changes have been announced in capital gains tax of debt funds:-

- The most important change is in the holding period for long term capital gains. The holding period for long term capital gains has been increased from 12 months to 36 months. Therefore, if the investor redeems his or her debt fund units before 36 months, the capital gains will be taxed at the applicable income tax rate of the investor (refer to table 1).

- The second change is in the long term capital gains tax rate. In the previous regime, long term capital gain was taxed at 10% without indexation and 20% with indexation. In 2014 Budget, the Finance Minister has increased the long term capital gains tax to 20%. However, indexation benefits have been allowed when computing long term capital gains.

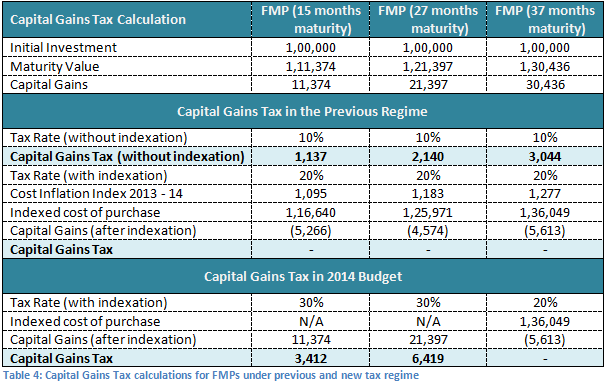

These changes will have an impact on the post tax returns of debt funds, and will effectively remove the big tax advantage that Fixed Maturity Plans used to enjoy versus Fixed Deposits. We will try to understand the effect of the change in the long term capital gains tax, with the help of an example. Let us make the following assumptions:-

- You want to invest Rs 1 lakh each in 3 FMPs maturing in 15, 27 and 37 months respectively.

- The FMPs give a pre-tax return of 9% on a compounded annualized basis.

- You are in the 30% income tax bracket

- For the purpose of indexation, the inflation rate is 8% (Cost of inflation index in 2013 – 2014 was 939).

Let us calculate what your capital gains tax will be for each of the three FMPs under the previous tax regime and the new tax regime (2014 Budget).

We can see in the table above, that the capital gains tax for investments less than 36 months is considerably higher in the 2014 Budget. The new capital gains tax rules for debt funds will undoubtedly make FMPs with maturities lower than 36 months, less attractive than in the past. However, post tax return on debt fund investments, particularly open ended intermediate term debt funds, long-term debt funds etc, where you have an investment horizon of more than three years, could still be higher than returns on fixed deposits. Even FMPs with maturities exceeding 36 months, can give higher returns than fixed deposits.

For equity funds (funds in which at least 65% of the portfolio are allocated to equities) there is no change in capital gains tax. The change in capital gains tax for debt funds will make arbitrage funds more attractive for investors with low risk appetite. Arbitrage funds aim to give risk free returns to the investors. Since arbitrage funds are risk free by definition, they are often compared to liquid funds. Over the past one year or so, arbitrage funds have given as much returns as liquid funds. However, the tax treatment of arbitrage funds is same as equity funds. If you opt for the dividend option in an arbitrage fund, then the fund does not have to pay dividend distribution tax, unlike debt and liquid funds. If you hold your arbitrage fund for over a year, the long term capital gains tax is nil.

Dividend Distribution Tax:

The Finance Minister has changed the methodology of calculation of Dividend Distribution Tax (DDT). In the previous tax regime, DDT was levied on the net dividends (after DDT) paid to the shareholders. As per this Budget, DDT will be levied on the gross amount, i.e. the dividends declared before DDT. This change applies to both companies and mutual funds. Finance Minister, Arun Jaitley’s logic for this change was that, there was an anomaly in the taxation of dividends, when tax liability of the dividends was shifted from the shareholder to the company. His point is, when dividend was taxable in the hands of the shareholder, the shareholder paid dividend tax on the total dividend received by him or her. On the other hand, when the company paid dividend distribution tax, it paid tax only on the dividend received by the shareholder, thereby effectively paying a lower rate of tax. While one can argue either way, the net effect of this change is that, the outgo on dividend distribution will be higher and the dividend received by the shareholder will be lower.

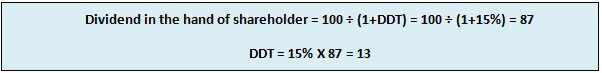

Let us try to understand, how this will impact shareholders and investors of non equity mutual funds. Investors should note that dividends of equity mutual funds (funds in which at least 65% of the portfolio are allocated to equities) are exempt from dividend distribution tax and therefore this change has no impact for equity mutual funds. It will only impact shareholders of companies (i.e. investors who own shares of companies) and investors of non equity mutual funds. Let us first understand how it will impact shareholders. In the previous regime, the DDT was 15% and was levied on the net dividends received by the shareholders. Suppose a company has Rs 100 to be distributed as dividends. Since in the previous tax regime, DDT was levied on the actual dividend received by the shareholder, the net dividend to shareholders was calculated using the following formula:-

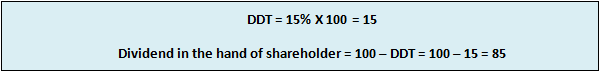

Therefore the shareholder received Rs 87 and the company paid Rs 13 as DDT. In theis budget, the DDT and the net dividend will be:-

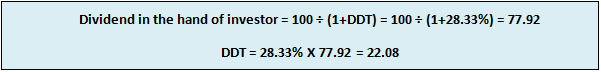

Let us now see, how this will impact the investors of dividend paying non equity mutual funds. For retail investors the DDT is 28.33%, including the surcharge of 10% and educational cess of 3%. Let us assume the fund has a distributable surplus of Rs 100. Since in the previous tax regime, DDT was levied on the actual dividend received by the investor, the net dividend to the investor was calculated using the following formula (please note it is the same formula as above):-

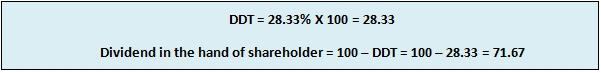

Therefore the investor received Rs 77.92 and the fund paid Rs 22.08 as DDT. In the new budget, the DDT and the net dividend will be:-

Therefore, the investor will receive about Rs 6 less, and the Government will get Rs 6 more in DDT. This means that dividends in the hand of the investor will go down by 8%. The changes in DDT and long term capital gains tax in this Budget have been negatives for debt funds. However, the good news is that there have no changes for equity funds.

Kisan Vikas Patra:

Kisan Vikas Patra, which was withdrawn in 2011, has been re-introduced in this budget. Kisan Vikas Patra offers an interest of 8.4%. You can also make cash investments in Kisan Vikas Patra.Rajeev Gandhi Equity Savings Scheme:

The Rajeev Gandhi Equity Savings Scheme (RGESS) will continue. It was rumoured that the NDA Government may discontinue this scheme. However, the rumours have been unfounded. Investors can continue to avail tax saving benefit (under Section 80C) by investing in RGESSBenefits for Senior Citizens:

The previous NDA Government had introduced the Varishtha Pension Bima Yojana for senior citizens. The 2014 Budget has proposed to revive, Varishtha Pension Bima Yojana for a limited period from August 15 2014 to August 14 2015. Also, a committee will be formed to examine and recommend how unclaimed amounts with PPF, Post Office, saving schemes etc. can be used to protect and further financial interests of the senior citizensUniform KYC norms and single Demat account:

Introduction of uniform KYC norms and inter-usability of the KYC records across the entire financial sector will help simply the investment process. Once implemented, this will help the investor view their whole portfolio, consisting of demat accounts, all mutual funds and insurance policies on one platform.

Conclusion

The Union Budget has lots of positives and a few negatives. But the positives outweigh the negatives. After all, the Finance Minister has given Rs 15,000 to Rs 35,000 extra in your hand, through the increase of the basic exemption limit, increase in 80C limit and increase in limit of deduction for interest payment on housing. The changes in long term capital gains tax for debt funds and dividend distribution tax have been disappointments. But maybe it is a blessing in disguise. The Budget may force some investor to look at a longer term investment horizon. You should look at your asset allocation and ensure that is aligned with your risk tolerance.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team