Aditya Birla Sun Life Mutual Fund launches Target Maturity Fund Investing in India's Top NBFCs & HFCs

Mutual Fund

The NFO will be open for subscription from 30th September, 2024 to 7th October, 2024

The Target Maturity Fund will track the CRISIL-IBX AAA NBFC-HFC Index-Sep 2026

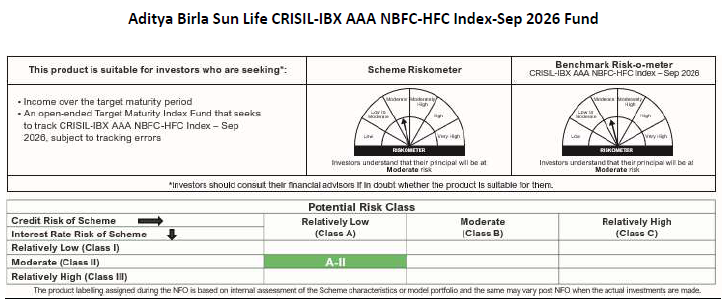

Mumbai, September 30, 2024: Aditya Birla Sun Life AMC Limited (ABSLAMC) was incorporated in the year 1994. Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. are the promoters and major shareholders of the Company. ABSLAMC is primarily the investment manager of Aditya Birla Sun Life Mutual Fund, a registered trust under the Indian Trusts Act, 1882. The asset manager has announced the launch of a Target Maturity Fund Investing in India’s top NBFCs & HFCs. The Aditya Birla Sun Life CRISIL-IBX AAA NBFC-HFC Index-Sep 2026 Fund, is an open-ended fund, with moderate interest rate risk and relatively low credit risk. The New Fund Offer (NFO) will remain open from 30th September, 2024 to 7th October, 2024.

The fund will focus on a Buy & Hold Strategy and the portfolio will comprise of 100% AAA-rated corporate bonds in the NBFC and HFC space, offering investors high-quality debt exposure. Rebalancing will take place semi-annually in April and October until the index maturity on 30th September, 2026, unless bonds become ineligible. This strategy offers a structured approach to long-term investment in the robust NBFC and HFC sectors.

Commenting on the new fund launch, A. Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC Ltd, said, “In an environment where stability and quality are paramount, the target maturity fund investing in India’s top NBFCs & HFCs offers a robust investment opportunity. Corporate bond yields and liquidity are notably well-balanced at the 2 and 3-year maturities, offering a timely investment opportunity. If yields decline going forward, investors could benefit from potential price appreciation, particularly in high-quality papers. With attractive yields and a favorable risk-reward profile, a roll-down strategy is particularly well-suited to the current interest rate environment”.

The fund's investment approach will appeal to investors seeking a passive debt strategy with an investment horizon ranging from 3 to 24 months with yields in India expected to remain attractive along with a relatively stable credit risk profile.

About Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited (ABSLAMC) was incorporated in the year 1994. Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. are the promoters and major shareholders of the Company.

ABSLAMC is primarily the investment manager of Aditya Birla Sun Life Mutual Fund, a registered trust under the Indian Trusts Act, 1882. ABSLAMC also operates multiple alternate strategies including Portfolio Management Services, Real Estate Investments and Alternative Investment Funds. ABSLAMC is one of the leading asset managers in India, servicing around 9.4 million investor folios with a pan India presence across 300 plus locations and overall AUM of Rs. 3,676 billion for the quarter ending June 30, 2024 under its suite of Mutual Fund (excluding domestic FoFs), Portfolio Management Services, Alternative Investment Funds, Offshore and Real Estate offerings.

About Aditya Birla Capital Limited

Aditya Birla Capital Limited (“ABCL”) is the holding company for the financial services businesses of the Aditya Birla Group. Through its subsidiaries/JVs, ABCL provides a comprehensive suite of financial solutions across Loans, Investments, Insurance, and Payments to serve the diverse needs of customers across their lifecycle. Powered by over 50,000 employees, the businesses of ABCL have a nationwide reach with over 1,505 branches and more than 200,000 agents/channel partners along with several bank partners.

As of June 30, 2024, Aditya Birla Capital Limited manages aggregate assets under management of Rs. 4.63 Lakh Crore with a consolidated lending book of Rs 1.27 Lakh Crore through its subsidiaries/JVs.

Aditya Birla Capital Limited is a part of the US$66 billion global conglomerate Aditya Birla Group, which is in the league of Fortune 500. Anchored by an extraordinary force of over 187,000 employees belonging to 100 nationalities, the Group is built on a strong foundation of stakeholder value creation. With over seven decades of responsible business practices, the Group’s businesses have grown into global powerhouses in a wide range of sectors - from metals to cement, fashion to financial services and textiles to trading. Today, over 50% of the Group’s revenues flow from overseas operations that span over 40 countries in North and South America, Africa, Asia, and Europe.

About Sun Life

Sun Life is a leading international financial services organization providing asset management, wealth, insurance and health solutions to individual and institutional Clients. Sun Life has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of June 30, 2024, Sun Life had total assets under management of $1.46 trillion. For more information, please visit www.sunlife.com. Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

For media queries please connect with:

Aditya Birla Sun Life AMC Limited

Jayesh Khilnani

Email: jayesh.khilnani@adityabirlacapital.com

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025