Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Mutual Fund

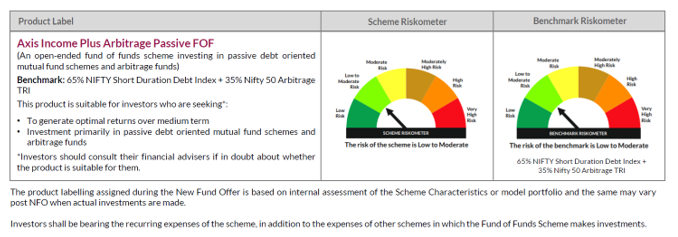

(An open-ended fund of funds scheme investing in passive debt oriented mutual fund schemes and arbitrage funds)

Highlights of Axis Income Plus Arbitrage Passive Fund of Fund

- Benchmark: 65% NIFTY Short Duration Debt Index + 35% Nifty 50 Arbitrage TRI

- NFO Period: Oct 28, 2025 to Nov 11, 2025

- Fund Manager(s): Devang Shah, Aditya Pagaria, Hardik Satra, Karthik Kumar

- Asset Allocation: Units of Mutual Fund Schemes: 95-100% of which:

- Units of passive debt oriented mutual fund schemes: 50-65%

- Units of Arbitrage Funds: 35-50%

- Money Market Instruments: 0-5%

- Minimum Application Amount: ₹100 and in multiples of ₹1/- thereafter

- Exit Load: Nil

Mumbai, 27th Oct 2025: Axis Mutual Fund, one of India's leading asset management companies, today announced the launch of the Axis Income Plus Arbitrage Passive FOF, an innovative open-ended scheme designed to offer investors a blend of stability, predictability, and tax efficiency. The New Fund Offer (NFO) will open for subscription on Oct 28, 2025, and close on Nov 11, 2025. The fund is managed by Devang Shah (Head - Fixed Income), Aditya Pagaria (Senior Fund Manager), Hardik Satra (Senior Fund Manager), and Karthik Kumar (Fund Manager).

This new offering is tailored for investors seeking to optimize their post-tax returns while maintaining a conservative risk profile. The fund strategically combines investments in passive debt-oriented mutual fund schemes with arbitrage funds, creating a hybrid structure that aims to deliver consistent returns over a medium-term horizon.

Commenting on the launch, B. Gopkumar, MD & CEO, Axis AMC said, "At Axis Mutual Fund, our focus has always been on delivering innovative, investor-centric solutions that combine performance with simplicity. The Axis Income Plus Arbitrage Passive FOF is a testament to this philosophy-offering a unique blend of stability, transparency, and tax efficiency. In a market where predictability and post-tax returns matter more than ever, this fund is designed to empower investors with a smarter way to approach fixed income investing."

Key Highlights of Axis Income Plus Arbitrage Passive FOF

The scheme is structured to invest approximately 50-65% of its portfolio in passive debt-oriented mutual fund schemes, targeting high-quality - instruments. The underlying schemes would follow a roll-down strategy, which allows investors to benefit from accrual income while minimizing interest rate risk. The remaining 35-50% of the portfolio is allocated to arbitrage funds, which involve fully hedged equity positions. This component is designed to generate returns with minimal volatility, as it avoids directional market exposure. The combination of these two components ensures that the fund delivers debt-like returns with enhanced tax efficiency.

The scheme is benchmarked against a composite index comprising 65% NIFTY Short Duration Debt Index and 35% Nifty 50 Arbitrage TRI, reflecting its dual exposure. The fund offers high liquidity with T+2 redemption payouts and no exit load, making it a flexible option for investors. Additionally, the fund's structure ensures no tax liability on rebalancing of the underlying schemes, further enhancing its efficiency.

Why Invest in Axis Income Plus Arbitrage Passive FOF

This fund is ideally suited for corporates, high-net-worth individuals (HNIs), and retail investors who are looking for a low to moderate risk investment that aims to offers fairly stable returns over a medium-term horizon. The use of passive roll-down strategies in the debt component provides visibility into returns when held to maturity, while the arbitrage allocation adds a layer of return enhancement with minimal incremental risk.

One of the most compelling reasons to invest in this fund is its tax efficiency. Unlike traditional debt mutual funds or fixed deposits, which are taxed at the investor's slab rate, the Axis Income Plus Arbitrage Passive FOF qualifies for long-term capital gains (LTCG) taxation at just 12.5% if held for more than 24 months.

"With the current market environment offering attractive accrual opportunities and investors increasingly seeking tax-efficient alternatives to traditional fixed income products, the Axis Income Plus Arbitrage Passive FOF can be a timely solution," said Ashish Gupta, CIO, Axis AMC. "By leveraging passive roll-down strategies and fully hedged arbitrage exposure, the fund is designed to offer a predictable and transparent investment experience."

Moreover, the fund addresses key investor concerns-often referred to as the "5Ps": Problem of Plenty, Predictability, Portfolio transparency, Post-tax returns, and Protection from credit events. By targeting to invest in a high-quality portfolio, the fund aims to minimize credit risk. Its passive structure aims for transparency and predictability, while the hybrid allocation model offers diversification and resilience across market cycles.

Source: RBI, Axis MF Research as on 10th Oct 2025

Product Labelling & Riskometer: Axis Income Plus Arbitrage Passive FOF (an open-ended fund of funds scheme investing in passive debt oriented mutual fund schemes and arbitrage funds)

Please refer to SID for detailed Investment Strategy and other scheme related features available at axismf.com

About Axis AMC:Axis AMC is one of India's fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds (https://www.axismf.com/), portfolio management services and alternative investments (https://www.axisamc.com/homepage).

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable. The above should not be construed as an investment advise. Axis MF/AMC is not guaranteeing any returns on any investments.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The views expressed herein are as on 3rd Oct 2025 based on the current market conditions and are subject to change depending on the Fund Managers view on the market scenario from time to time.

Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025