Notice cum Addendum - Change in the fundamental attributes of Mirae Asset Cash Management Fund

Mutual Fund

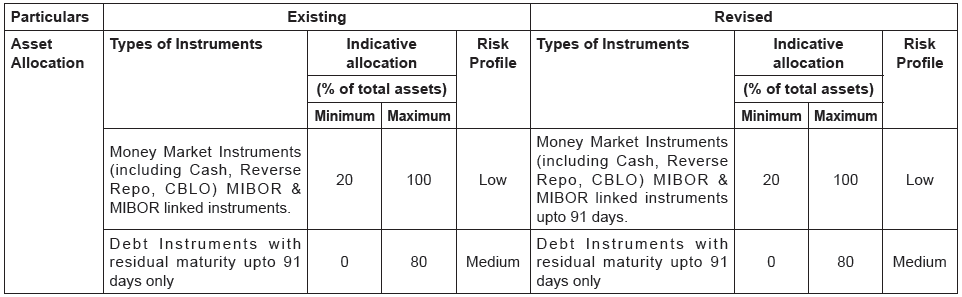

Investors / Unitholders are requested to take note that Mirae Asset Trustee Company Private Limited (‘the Trustee Company’) has approved the following changes in fundamental attribute of Mirae Asset Cash Management Fund, an open-ended liquid scheme (‘the Scheme’) post the “No Objection” letter issued by SEBI vide its letter no. IMD/DF3/OW/P/2017/33071/1 dated December 27, 2017. The following change will be effective from March 14, 2018:

As per the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 any modification in the asset allocation of a scheme amounts to a change in the fundamental attribute of the scheme. Accordingly, as per Regulation 18(15A) of the said regulation, in case an investor does not wish to continue to hold units in view of the said changes, he / she / it will have the option to exit the said Scheme at the prevailing NAV, without any exit load. The said exit option can be availed between Monday, February 12, 2018 to Tuesday, March 13, 2018 (upto 3 p.m.) (both days inclusive). The aforesaid exit option will be available to all the investors of the Scheme as on February 09, 2018. All transaction requests received on or after Wednesday, March 14, 2018, will be subject to load, as may be prevailing in the respective Scheme mentioned above. It may be noted that the offer to exit is merely an option and is not compulsory. Please note that redemption request may be submitted to any of the Offices of the AMC or the Karvy Investor Service Centers. Such exit option will not be available to unitholders whose units have been pledged and Mutual Fund has been instructed to mark a lien on such units and the release of the pledge is not obtained and appropriately communicated to Mutual Fund prior to applying for redemption. The redemption proceeds shall be dispatched within 10 (ten) business days of receipt of valid redemption request to those unitholders who choose to exercise their exit option. Unitholders should ensure that any change in address or payout bank details required by them, are updated with the AMC before exercising the exit option.

Redemption / switch-out of units from the said scheme, during the exit period, may entail capital gain in the hands of the NRI unit holder, and such TDS on account of capital gain shall be deducted in accordance with the applicable Tax laws, upon exercise of exit option, which shall be required to be borne by such NRI investor(s) only. The redemption / switch of units from the said scheme is currently not liable for deduction of Securities Transaction Tax (STT); however, if any, such STT shall be borne by AMC and will not be borne by the investor.

In view of individual nature of tax implications, unitholders are advised to consult their tax advisors. If the units are held in dematerialized form, investors are requested to contact their Depository Participant for their transactions.

Unitholders who do not exercise the exit option during the said exit window period would be deemed to have consented to the proposed modification. It may also be noted that no action is required in case Unitholders are in agreement with the aforesaid changes, which shall be deemed as consent being given by them for the proposed changes.

All the terms and conditions of the Scheme apart from those mentioned above will remain unchanged.

This Notice-cum-Addendum forms an integral part of the Scheme Information Document (SID) / Key Information Memorandum (KIM) of Mirae Asset Savings Fund. The SID, KIM and Application forms are available at AMC Branches / Mutual Fund website www.miraeassetmf.co.in or at Investor Service Centers / Distributors.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025