Principal Balanced Fund AUM crosses Rs 1,000 Crores

Mutual Fund

Principal Balanced Fund assets under management (AUM) crossed Rs 1,000 on January 25, 2018. The scheme AUM grew around 20 times in just over 12 months. The fund helmed by veteran fund managers PVK Mohan and Bekxy Kuriakose gave nearly 34% returns in the last one year. Principal Balanced Fund is one of the best performing balanced funds over the last 3 years, giving annualized returns of nearly 16% over the same period. The is also one of the most consistent performers in the last 5 years – it ranked in the top two quartiles in most years over the last 5 years (please see our tool, Top Consistent Mutual Fund Performers).

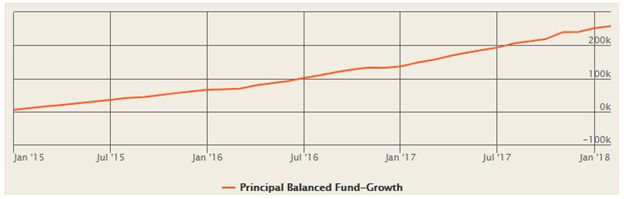

A lump-sum investment of Rs 1 lakh in Principal Balanced Fund (Growth Option) would have grown to over Rs 1.5 lakhs in the last 3 years.

Principal Balanced Fund also delivered strong capital appreciation through SIP and lump sum. A monthly SIP of Rs 5,000 in Principal Balanced Fund (Growth option) since Jan 1, 2015 would have grown to Rs 2.58 lakhs by Jan 17, 2018 against an investment of just Rs 1.80 Lakhs only. The annualized SIP return (XIRR) over the last 3 years was nearly 23%.

Source: Advisorkhoj Research

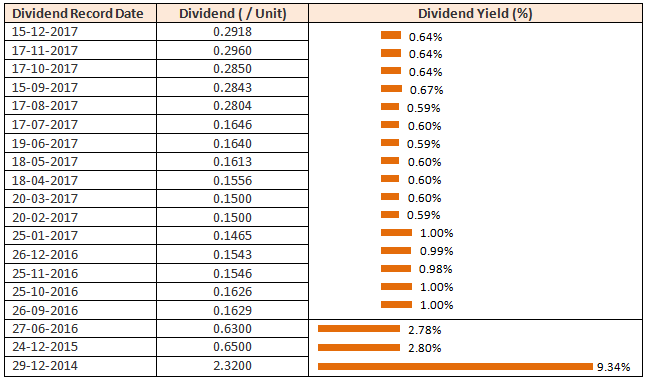

Principal Balanced Fund has a strong dividend pay-out track record over the past 4 years and has paid out monthly dividends consistently over the past 12 to 15 months.

Source: Advisorkhoj Historical Dividends

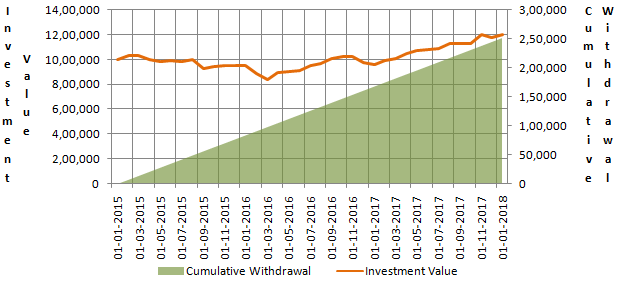

Principal Balanced Fund’s Regular Withdrawal Plan can create regular income stream for the investor and also capital appreciation for moderate withdrawal rates. The chart below shows the illustrative cash-flows and valuation of Regular Withdrawal Plan. In this example, we have assumed that an investor made a lump sum investment of Rs 10 lakhs in Principal Balanced Fund on January 1, 2015 and opted for regular withdrawal of Rs 7,000 per month from the next month onwards (annual withdrawal rate of 8.4%). As on January 18, 2018 the investor would have made a cumulative withdrawal of Rs 2.52 lakhs and current residual value of the investment would nearly Rs 12 lakhs.

Source: Advisorkhoj SWP calculator

In the above example despite making regular monthly withdrawals at the rate of 8.4% per annum, the strong performance of Principal Balanced Fund enabled the value of the investment grew 20% on an absolute basis over and above the regular withdrawal plan period.

The fund is open to subscription under regular and direct plans. Growth and monthly dividend options are available. Under its dividend option, the investor can choose between payout, re-investment and sweep. The fund also provides SIP, STP and RWP facilities.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025