Top 10 Best Mutual Funds to invest in 2016: Diversified Equity Funds

Diversified equity mutual funds are the most popular category of mutual funds among retail investors. Diversified equity funds invest in companies across industry sectors and market capitalization segments. These funds, also known as Flexicap or Multicap funds combine the best features of large cap and midcap funds. The large cap holdings of the flexi cap funds provide a certain degree of stability in volatile markets, while the small and midcap holdings enhance the returns in bull markets.

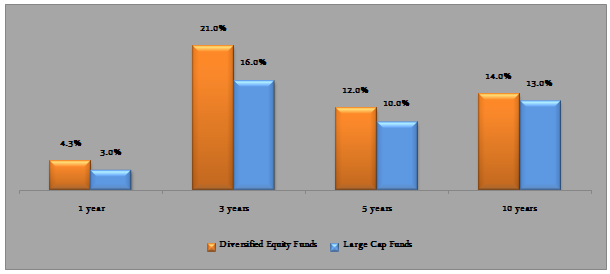

Readers should note that in terms of risk return characteristics, diversified equity funds are usually resemble large cap funds more than midcap funds. However, diversified equity funds have outperformed large cap funds both in terms of trailing returns over different time-scales. The chart below shows the annualized trailing returns of diversified equity and large cap fund categories over the last 1, 3, 5 and 10 years (period ending June 15, 2016).

Source: Morningstar

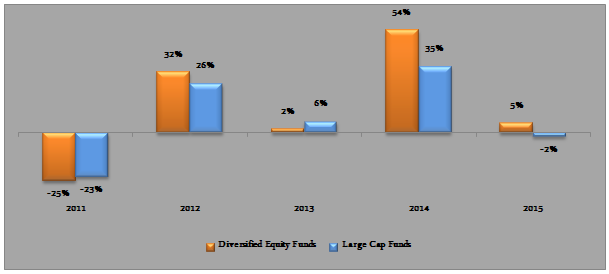

Even in terms of annual returns diversified equity funds outperformed large cap funds in most years over the last 5 years.

Source: Morningstar

You can see that, even when the market corrected by more than 20% in 2011, diversified equity funds returns were only slightly worse than large cap funds. On the other hand, when the market rallied in 2012 and 2014, diversified equity funds outperformed large cap funds by a wide margin. In the last 1 year when the market corrected sharply, diversified equity funds outperformed large cap funds. This is because, contrary to what we usually expect in volatile markets, small and midcap stocks outperformed large cap stocks last year. A major reason behind outperformance of midcap stocks last year was Foreign Institutional Investor (FII activity), which adversely impacted large cap stocks.

You may like to read Investing in diversified equity funds is a safer option

In this post we will review some of the top performing diversified equity funds for investment in 2016, based on CRISIL’s latest mutual fund ranking (for the quarter ended March 2016). CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk.

Each of the diversified equity funds in our selection has been assigned either Rank 1 or 2 by CRISIL. In addition to CRISIL ranking we have applied a secondary filter based on our own research. Our secondary filter is based on quartile ranking. Mutual Fund Quartile ranking is an analytical tool which measures of how well a mutual fund has performed against all other funds in its category. From the CRISIL top ranked diversified equity funds, we have selected only those funds, which are currently ranked in the top quartile based on trailing 3 year returns.

Further, in order to see performance consistency, we have limited our selection to funds, which were in the top quartile in the previous two quarters as well (please see our quartile ranking tool for Diversified Equity funds).

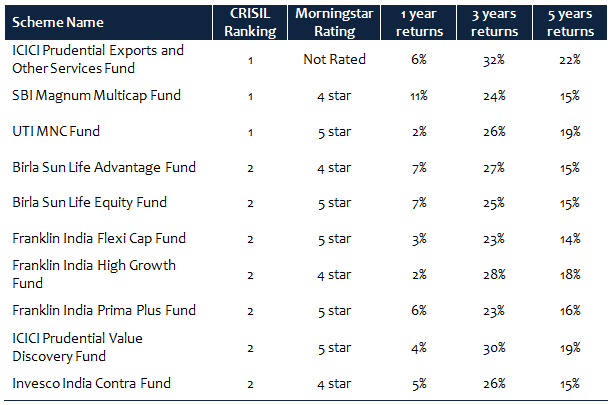

The table below lists the top 10 diversified equity funds based on criteria discussed above.

Source: Advisorkhoj Research, CRISIL, Morningstar

You can see in the above table that the three year annualized trailing returns of all these funds are more than 20%. Even the 5 year annualized returns are above 15%, with some funds delivering close to 20% returns or even more.

Please note the fund categorization of CRISIL is slightly different from the fund categorization our research team. While CRISIL categorizes ICICI Prudential Exports and Other Services Fund and UTI MNC Fund as diversified equity funds, our team has categorizes these two funds as thematic funds and within thematic funds, ICICI Prudential Exports and Other Services Fund and UTI MNC Fund have consistently ranked in the top quartile. However, for the purpose of the post, we will stick to the CRISIL categorization. The other 8 funds in the list of top 10 diversified equity funds as per CRISIL ranking matches with our fund categorization.

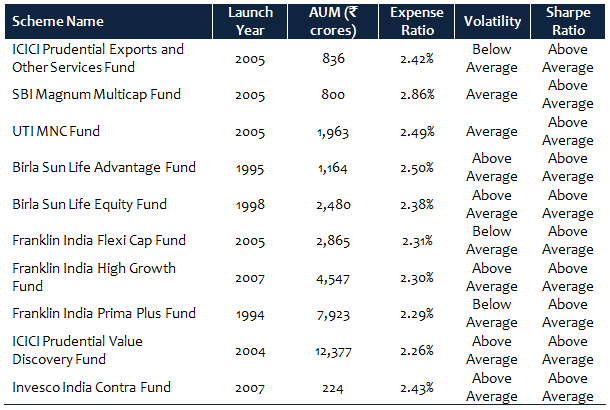

Let us look at some other key statistics, like launch year, Assets under Management, Expense Ratio, Volatility (measured in terms of standard deviation of monthly returns) and Sharpe Ratio (a measure of risk adjusted returns) of these Top 10 Diversified Equity Funds.

Source: Advisorkhoj Research

You can see in the table above that AUM of these funds range from little over र 200 crores to north of र 12,000 crores. In our blog, we have stated a number of times that for diversified equity funds AUM size is not important. You can also see that the expense ratios of these funds range from below 2.3% to nearly 2.9%, but the Sharpe Ratio (a measure of risk adjusted returns) of all these funds are above average. This reinforces what we have stated in our blog that expense ratio is not very important for equity funds, as long as the fund manager is able to generate good alphas (please see our post, How much importance should mutual fund investors give to expense ratios). There is no statistical evidence of low expense ratio equity funds delivering superior performance compared to high expense ratio equity funds. As an investor, you should select equity funds based on the track record of the scheme, fund manager and the AMC.

Conclusion (of this part)

Diversified equity mutual funds which invest across market capitalizations and sectors are ideal long term investment options for retail investors. As such these funds should form a substantial part of an investor's mutual fund portfolio. You may find this post interesting - Mutual fund diversified multi-cap funds are ideal for retail investors

In this post, we have seen the top 10 diversified equity funds, based on CRISIL’s latest mutual fund ranking (for quarter ended March 2016) and also our internal quartile ranking based criteria. In the next part of this post, we will do a brief review each of these funds. Stay tuned for more.

You may also like to read:

Nearly 40 times return in 20 years

Best performing diversified equity fund in the last 10 years

How SIPs in top 7 best diversified equity funds have created wealth

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team