Axis Mutual Fund: Budget 2022 Approaching an Amrut Kal

Mutual Fund

Sustainable development is the pathway to the future we want for all. It offers a framework to generate economic growth, achieve social justice, exercise environmental stewardship and strengthen governance.

- Ban Ki-moon (Former Secretary General of the United Nations)

Introduction

The honourable finance minister, Nirmala Sitharaman, delivered a pragmatic yet capex heavy budget aimed at addressing key bottlenecks in the Indian economy. Spearheaded by government spending on long term projects, the government has aimed to remove stumbling blocks to economic growth.

The finance minister outlined 4 focal points that Budget 2022 aimed to address

Key Highlights

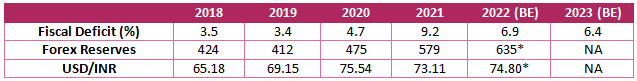

- Fiscal Deficit for FY 2021-22 pegged at 6.9% (RE), FY 2022-23 at 6.4%. Will return to the recommended level of ~3% by FY26

- Government Capex for FY 23 hiked 30%+ to Rs 7.5 lakh Cr

- No changes to personal income tax limits or tax brackets

- Gross government borrowing for FY 23 pegged at Rs 14.96 lakh crore

- New taxation structure on virtual digital assets

- Long term cap gain tax surcharge capped at 15%

- FY 23 divestment target significantly smaller at Rs 65,000 Cr

Budget Takeaways

Budget 2022 continues to drive the investment push from the top as the government engages all leavers to ensure that the Indian economy remains the fastest growing large economy on the planet. New initiatives on promulgating the startup ecosphere and improving ease of doing business are likely to give markets direction on the government’s thinking of a future ready Indian economy. Notably in its attempt to push growth, the government has significantly opened up the economic wallet leveraging the above estimate revenue collections and a large borrowing program

Capex all the way – Focus on Implementation will be key

The PM Gatishakti program to improve connectivity and reduce logistical bottlenecks is likely to drive Capex spending for the year. A significant jump in capex allocation (Rs 7.5 lakh Cr a 30%+ jump from 2021) if implemented well will act as significant conduits from the domestic economy.

The series of programs aimed at improving local standard of living like the ‘PM Awaas Yojana’, ‘Jal se Nal’ yojana and programs around education and healthcare could infuse fresh blood in areas of the Indian economy that can be perceived as ‘low hanging fruits’ for development.

For FY22 (BE)–Capex will roughly account for ~3% of GDP. The government has also increasingly used state bodies and the state machinery to ensure better utilization and larger multiplier effect with large infrastructure projects. Synergies will be key to watch out for in the year ahead.

Sustainability & the Need to Promote Sunrise Industries

Recognizing the need to cultivate and develop technologies of the future the government has committed to supporting sustainable technologies through several targeted development programs. A New Production linked incentive scheme (PLI) for the solar industry and introduction of Sovereign Green bonds for Carbon neutral projects has also been proposed

Bond Inclusion Hopes Dashed

The budget speech and documents did not discuss the changes to capital gains tax for India bonds that could have enabled inclusion into bond indices. The likelihood is low for it to be taken up in this Budget session of the Parliament with the Finance Bill already tabled. With a larger than expected supply to absorb, this disappointment has driven bond yields sharply higher.

Crypto, Block chain & Digital Assets

In an attempt at regulation and as a perceived precursor to the possible Crypto Currency bill, the Budget outlined a series of measures to ensure adequate regulatory cover to navigate the evolving ecosphere. Notable announcements include

- A New Digital Rupee backed by the RBI harnessing the attributes of block chain to boost the digital economy and offer a more efficient and cheaper currency management system

- Introduction of a specific Taxation regime of Virtual digital assets

- TDS on transfer of digital assets

Way forward & Market View

Budget day saw equity markets yo-yo as market participants digested the capex led budget with negative surprises on government financing. On the debt side the budget was a significant negative with higher spending targets and hopes of taxation reform for global bond inclusions not panning out as expected. The 10 Year G-Sec spiked 16bps to fresh 2 year highs.

Equity Markets

The Equity markets see the budget favourably primarily on 2 fronts – Higher capex spending by the government & status quo on direct taxes and no incremental taxes on capital gains. The booster shot by way of capex and a strong market signal to promote growth through structural reforms are key positives for domestic and foreign investors alike.

The budget is a strong positive indicator for growth potential of Indian companies. A 14% nominal growth in US$ 3.2 Trillion GDP provides ample headroom for companies to grow. Further with domestic economy companies in favour for much of the government’s capex outlay, economic multiplier effects should have a significant bearing on sectors like steel, cement, telecom and also trickle down effects into consumption.

Execution of Budget 2021 left a lot to be desired by way of execution. Budget 2022 in that sense is more pragmatic and we will wait to see how the government executes its bold capex play for the year. Our portfolios currently are positioned to play the growth story.

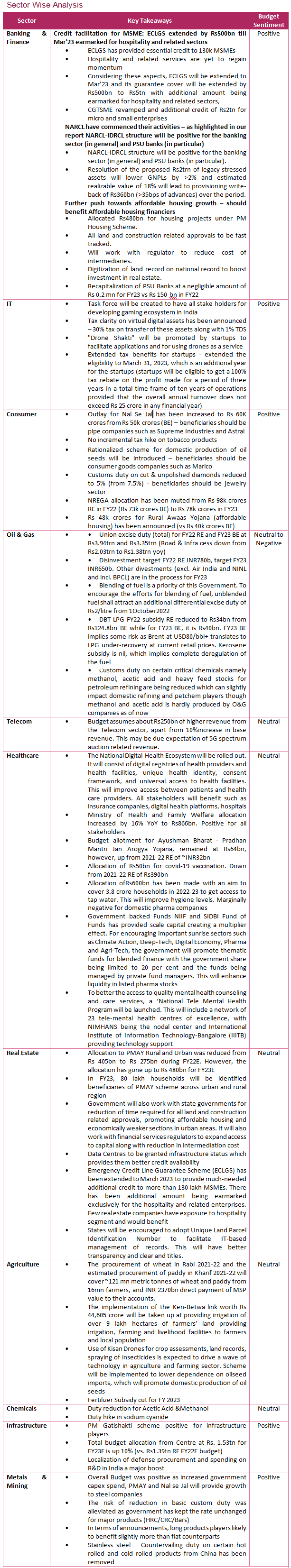

We have attached a sector wise snapshot for key sectors in the annexure below

Debt Markets

The budget was a sentimental let-down for the debt markets. The significantly higher borrowing target along with the global inclusion dampener will see rates moving higher incrementally. We expect the RBI to adjust monetary policy to factor the pro-growth budget and turn hawkish to counter the effects of anticipated inflation and the higher borrowing.

From a fixed income perspective, green sovereign bonds will be an interesting addition to the investment universe.

Investors looking to allocate to debt strategies are advised to look at fund segments with lower duration profiles and use target maturity strategies to gradually lock in incrementally higher rates over the next 6-12 months. Bond yields are likely to see increased volatility and hence investors should remain vigilant in their allocations.

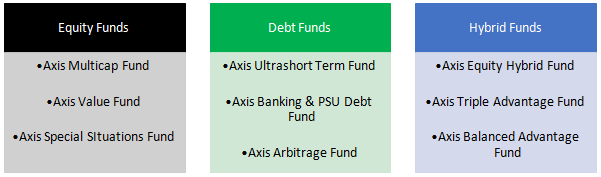

Focus Funds

Annexure

The above sector commentary is not a recommendation to trade in either stocks or sectors. The AMC/mutual fund may hold positions in many of the companies/sectors mentioned and may have taken trade actions post the publication of this note. The note should not be treated as a research note

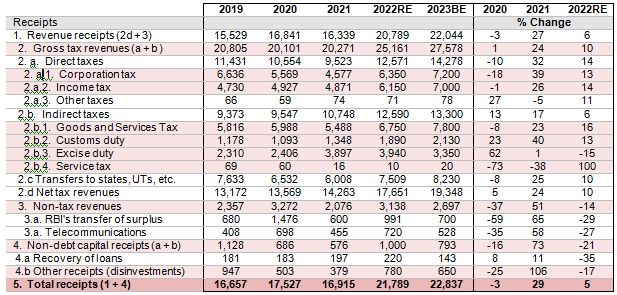

Revenue Snapshot

Source: Budget Documents FY 21-22, Kotak Institutional Equities. RE – Revised estimates

Key Summary Numbers

Source: Bloomberg, Axis MF Research. All Numbers as of respective Financial Year ends. * Data as of 1st Feb 2022 BE – Budgeted Estimates

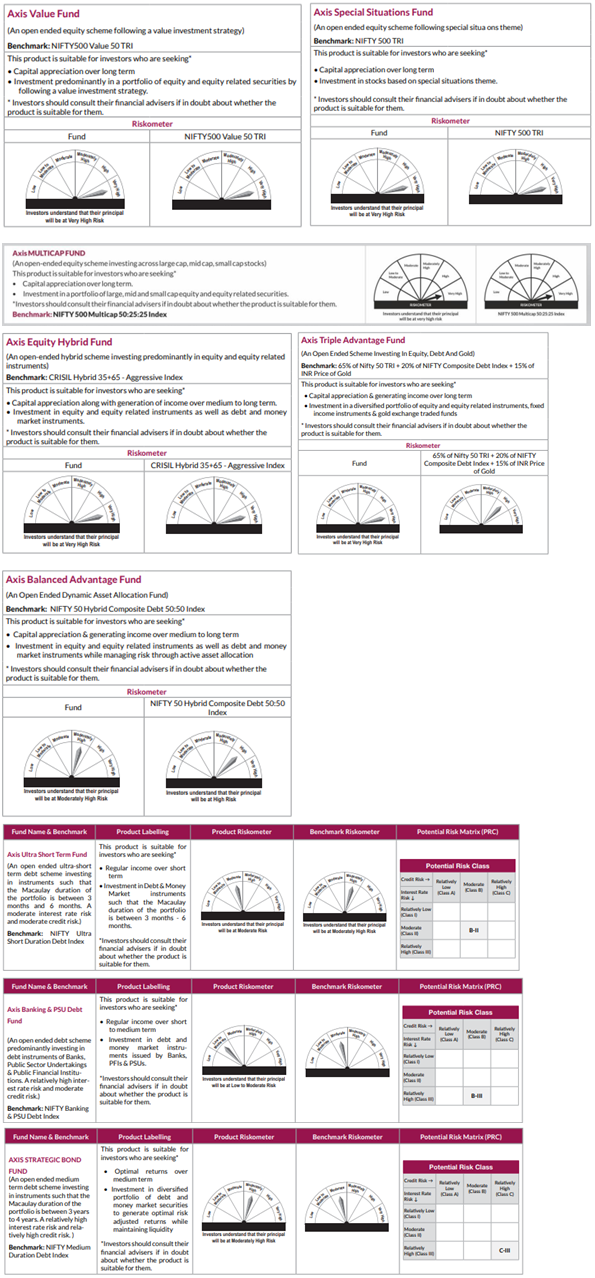

Product Labelling

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimers

Source: Axis MF Internal Analysis, Budget Documents 2022.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh).

Trustee: Axis Mutual Fund Trustee Ltd.

Investment Manager: Axis Asset Management Co. Ltd. (the AMC)

The above changes to taxation is subject to presidential assent to the finance bill 2022. Stocks/sectors mentioned may or may not form part of mutual fund portfolios. The note should not be treated as a research report. The document has been prepared on the basis on the budget documents published by the ministry of finance and should not be used for tax planning given the individual nature of income tax. This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable. While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025