ICICI Prudential Mutual Fund launches ICICI Prudential Growth Fund Series 3

Mutual Fund

NFO period: 17th September – 1st October, 2014

Highlights of the NFO:

- Identifying growth stocks within the framework of fundamentals and management quality.

- Opportunistically invest across market cap.

- Taking concentrated sector calls.

- Declaring commensurate dividends#

#Dividends will be declared subject to availability of distributable surplus and approval from Trustees.

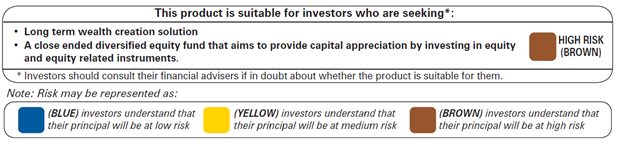

Mumbai, September 12, 2014: ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Growth Fund - Series 3, a three and half year close ended equity fund that aims to provide capital appreciation by investing in a well-diversified portfolio of equity and equity related securities.

Speaking on the launch of this fund and the thought behind it, Mr. Nimesh Shah, MD & CEO, ICICI Prudential Asset Management Company Ltd. said, “The economic transformation continues with major macroeconomic indicators showing a positive outlook. Macro stability conditions are expected to improve further with the key driver being sustained deceleration in Consumer Price Index Inflation. This pick up in sentiments is likely to actuate revenue growth for companies as Gross Domestic Product growth, demand up tick and profitability of companies have high positive correlation. We believe there is an opportunity available for equity markets with the earnings growth likely to improve going ahead.”

The fund will be managed by Manish Gunwani, Fund Manager who manages funds like ICICI Prudential Focused Bluechip Equity Fund and ICICI Prudential Balanced Advantage Fund to name a few.

There are sufficient reasons to launch Growth Fund- Series 3 at this juncture:

- The economy has turned the corner and is possibly out of the low growth - high inflation cycle. The macro trend so far has been encouraging with key macro indicators like Current Account Deficit (CAD), Balance of Payment (BOP), Inflation and Foreign Institutional Investor (FII) flows showing significant improvement.

- Decline in crude oil prices and recovery in the monsoon is positive for the economy.

- Improvement in industrial production numbers, auto sales growth, durables loan growth and diesel consumption ticking up are all signs of improved sentiments.

- With sentiments improving, demand is expected to pick-up, which is likely to boost revenue growth and profitability of various companies.

The minimum application amount for the fund is Rs 5,000 (plus in multiples of Rs.10)

ICICI Prudential Growth Fund Series- 3

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”.

Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

The AMC (including its affiliates), the Mutual Fund, the trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible/are liable for any decision taken on this material.

The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund.

About ICICI Prudential AMC:

ICICI Prudential Asset Management Company Ltd. (IPAMC) is a joint venture between ICICI Bank, a leading and trusted name in financial services in India and Prudential Plc, one of United Kingdom’s largest players in the financial services sector.

The company has forged a position of preeminence in the Indian Mutual Fund industry. It is one of the leading Asset Management Company’s contributing significantly towards the development of the Indian Investor and the growth of the Indian mutual fund industry.

From a well - diversified range of investment solutions that cater to all its investors needs to various facilities and services to make investing simpler, ICICI Prudential AMC is always looking to create long-term wealth and value for investors through innovation, consistency and sustained risk adjusted performance. Today, the organization is an ideal mix of investment expertise, resource bandwidth & process orientation. It is always looking to take an extra step to simplify its investor’s journey to meet their financial goals, while ensuring that it maintains pace with rapidly changing technologies.

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025