Mutual Fund ELSS can build Financial Future while Saving Taxes

August is already knocking on your door and once again it is time for you to file your Income Tax Returns for the last financial year. This is usually the time of the year that investors turn their attention to what they have invested in the last financial year and submit those details while filing the Income Tax returns.

Usually the trend is that investors would desperately invest anywhere in the month of March just to escape paying the taxes and they land on investing in schemes which is though helping them save tax in the short term but bear little or no benefits in the long run. Investors realize these while filing the Income Tax returns and repent later. Therefore, while you are preparing to file the returns for last financial year, here is a reminder to do your tax planning for the current financial year if you have not done it already.

Tax planning should not only be aimed at saving taxes but also to aid your investments to help you achieve your financial goals. Today, we will discuss how ELSS becomes the ideal option where you can get both - Save taxes and build a financial future.

What is ELSS

Equity Linked Savings Scheme (ELSS) was floated as per the ELSS guidelines issued by CBDT under section 80C of the Income Tax Act 1961 to encourage investments in equities by providing tax rebate. The amount, up to Rs 1.5 lakhs (For the current FY) if invested in ELSS is exempted from tax.

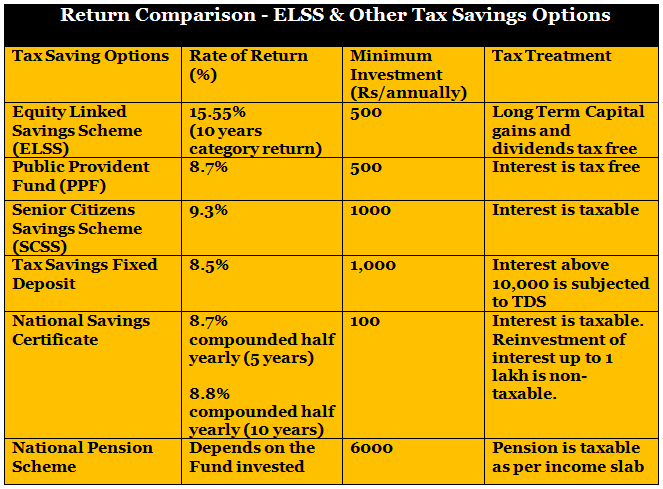

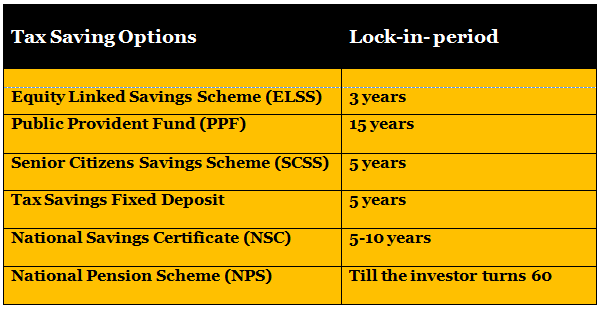

Investors who invest in ELSS are investing in a scheme where minimum 80% of the invested amount can be in equities and equity related schemes. Therefore, it is at par with any diversified equity fund. ELSS investments come with a three years lock in period where the long term capital gains and dividends are tax free. The lock in period is only three years making it the scheme with the shortest lock in period in tax saving options. Have a look at the table below to see how ELSS fares as compared to other tax savings options.

Why Should You Invest in ELSS

Killing Two Birds with One Stone

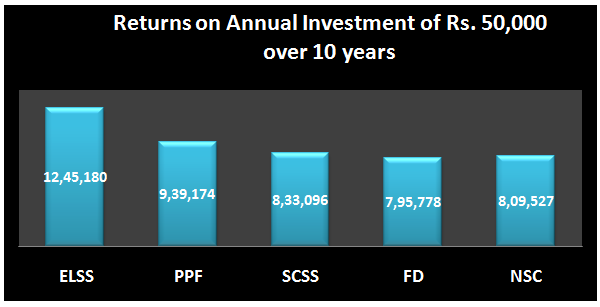

Tax planning should not be done at the cost of your financial planning. If an investment is being made just to save taxes then the fund utilized could adversely affect your financial future. Tax planning should be a priority but in the long run the investment should also yield substantial returns. Hence, by investing in ELSS you take benefit of tax planning and achieve your investment goals as ELSS substantially invests in equities. In the graph below shown are the returns that can be generated through various tax savings schemes over a period of ten years.

A Diversified Investment Fund

The fundamental idea behind the need for diversification is that all investments do not do well equally. Diversification stabilizes the investments by balancing out sectors or companies that are doing well versus the sector or companies that may not be performing well. ELSS follows the same mantra of diversification like an equity mutual fund investment. Investors, who invest in ELSS, invest in the equities of companies from various sectors. This reduces the risk on the part of the investor as the fund is already diversified. Diversification along with the lock in period of three years considerably reduces the risk and the dread that is usually associated with equity investing.

ELSS has The Shortest Lock in Period

ELSS has a lock in period of only three years making it the only tax saving option with the shortest lock in period. It makes ELSS more attractive as compared to the other tax savings options where the lock in period is at least five years to fifteen years. Let us now look below at the lock in period of various tax saving options.

Professional Management of Funds

The funds in an ELSS scheme are professionally managed by expert and qualified fund managers. ELSS allows us to invest in equities and reap the benefits but also redeems you of the responsibility of having to watch the nitty-gritty’s of the investments i.e. the equities to invest in, the best debt options and so on. These fund managers ensure that the funds are managed as per the mandate of the fund and maintain the equity and debt ratios to generate maximum returns.

ELSS is A Flexible Means of Investment

ELSS is an extremely flexible form of investment. Investors only have to adhere to minimum amount of investment and there is no maximum limit to the investment, though tax benefits are available only up to Rs 1.5 lakhs per financial year as per current tax rules. For example - an investor in PPF cannot invest more than 1.5 lakh annually, that being the maximum allowed investment. Investors can invest in small tranches of Rs 500 in ELSS whenever required, if they do not have lump sum at hand. Also, ELSS investments can be done through Systematic Investment Planning (SIP) route thus taking the benefit of rupee cost averaging. This method of investment is exclusive to Mutual Fund investments where as in other tax savings options annual investments or installments have to be made. Hence, the investors often have to invest lump sum which is not the case with ELSS. Investors in ELSS can also redeemed their investments partially after the lock in period while the remaining amount can stay invested.

Returns From ELSS Are Completely Tax Free

There is always a catch with most tax savings schemes. ELSS comes with no catch. There is dual benefit of investing in equities. Investment up to Rs 1.5 lakhs qualify for tax deductions under section 80/c of Income Tax Act 1961. The dividend generated and the long term capital gains are tax free as well. This is applicable only if the investment is redeemed after the lock in period of three years are over.

Conclusion

ELSS sounds like a victory scheme where you can save taxes without disrupting the investments for your financial future. No component of ELSS is taxable and you can generate returns by investing your money in equities. This implies your investments will be generating high returns and because the lock in period is three years the volatility of the returns will also be reduced. If you do not need the money after three years, remaining invested in ELSS can be helpful in realizing your long term financial goals as well.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team