Union Budget 2016-17: A perspective

General

We are happy to share some clarity on yesterday's Union Budget highlights which includes equity and debt markets, mutual funds, personal taxation and the much controversial proposal or debate on PPF and EPF and taxation of dividends.

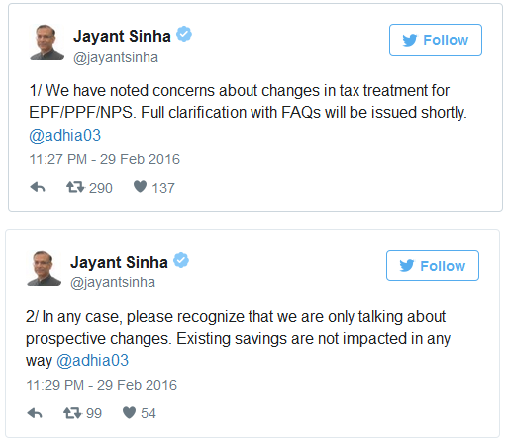

Yesterday evening Jayant Sinha, Minister of State for Finance tweeted that they have noted the concerns about the tax treatment for EPF/PPF/NPS and will issue a full clarification with FAQs. He also emphasized that these changes are not on retrospective basis and therefore existing savings are not impacted in any way.

Personal Taxation

While there are no changes in the tax slabs, Some relief for small resident tax payers comes in the form of a tax rebate enhancement under section 87A, from र 2,000 to र 5,000 with income not exceeding र 5 lacs per annum. Effectively, this means that the basic exemption is now र 3 Lacs. It is estimated that around 1 Crore tax payers would be benefited by this move. For example – a young guy earning say र 4.50 Lacs per annum will now be able to save र 3,090 in taxes!

The much expected tax on the rich has come in by way of an increase in the surcharge from 12% to 15%. This is applicable on individuals with a taxable income over र 1 crore per annum thus taking the maximum marginal rate of tax to 35.535% from 34.608%. For example – a super rich guy earning say र 1.20 Crores per annum will have to pay an additional tax of र 1 lac.

Relief for Freelancers and Professionals

Section 44AD is now extended to Professionals and Freelancers as well. This frees them from burden of book keeping and accounts and getting the accounts audit done. Now, Professionals and Freelancers with receipts up to र 50 lacs can now avail this benefit by paying tax at 50% of their gross receipts. The earlier provision was र 25 lacs only

As per Section 44AD of the Income-Tax Act, under the presumptive method, the tax liability is calculated on the basis of a 'presumed business income', irrespective of what your actual income may be. This is a significant development for freelancers and professionals such as lawyers, engineers, management consultants, doctors and interior designers etc. and brings much relief for them.

Tax on Dividends

One Budget proposal that created lot of heart burn yesterday amongst equity investors was announcement of 10% extra tax on dividends, if the gross dividend income received from Indian Companies is in excess of र 10 Lacs in a year. This is over and above the Dividend Distribution Tax (DDT) and corporate tax paid by the company declaring the dividend.

During the FM budget speech there was confusion if this would also apply in case of Mutual Funds. However, that stands clarified and it will not be applicable for Mutual Funds. All in all it is very good news for mutual fund investors and advisors. Some experts, however feel, that many stock market investors may now prefer to invest a big chunk of their portfolio via mutual funds route.

Further, the Budget proposal says that taxation of such dividends would be on gross basis, therefore, any expenses incurred to earn this dividend would not be allowed for any kind of deductions.

New benefits on Home Loans

The Budget announces first home buyers to get additional deduction of र 50,000 for home loan interest under section 80EEE only for loans up to र 35 lacs where the cost of house is less than or upto र 50 lacs. Overall, the first home buyer can get maximum deduction of interest on housing loan up to र 250,000 in aggregate comprising of र 2 lakhs under Section 24(b) of the Income Tax Act and र 50,000 under Section 80EE of the IT Act.

There is good news for other tax payers as well who are seeking benefit from home loans. The Government has proposed to extend the 3 year deadline to 5 years for claiming tax benefits in case of delayed possession of their houses due to delay in construction etc.

Capital Gains Not Applicable in Case of Merger of Mutual Fund schemes

Currently, capital gains tax is levied on consolidation or merger of multiple plans within a mutual fund (MF) scheme.

To increase retail participation in mutual funds, Finance Minister Arun Jaitley proposed extending capital gains tax exemption to merger of different plans in a Mutual Fund scheme.

Currently, capital gains tax is levied on consolidation or merger of multiple plans within a Mutual Fund (MF) scheme. However, fund houses are of the view that it is not feasible to levy capital gains tax when an investor moves from dividend option to growth option in a scheme.

"It is proposed to extend the tax exemption, available on merger or consolidation of MF, to the merger or consolidation of different plans in an MF scheme. “...any transfer by a unit holder of a capital asset, being a unit or units, held by him in the consolidating plan of an MF scheme, made in consideration of the allotment to him of a capital asset, being a unit or units, in the consolidated plan of that scheme of the MF shall not be considered transfer for capital gains tax purposes and thereby shall not be chargeable to tax," Finance Minister Arun Jaitley proposed in his Union Budget for 2016-17

House rent exemption benefit increased

The Budget proposal has fixed another major problem that is, increase in house rent exemption benefit for those who do not get house rent allowance as part of their compensation. Till now these tax payers could claim only a deduction of र 24,000 a year under section 80GG. This limit has now been increased to र 60,000 a year. This will provide much relief to individuals living on rent but do not get HRA. This will save as much as र 11,124 for those who are in the highest tax bracket.

Long term capital gain on unlisted Shares

In a major boost for shareholders of unlisted companies, finance minister Arun Jaitley on Monday reduced the duration of long-term capital gains period for unlisted companies from 3 to 2 years.

At present, shareholders had to hold shares of these unlisted companies for 3 years or more to avail 20% long-term capital gains tax. Share sale before 3 years attracted tax according to the prevailing income tax slabs, which was 30% in most cases. The move will make it easier for shareholders of unlisted firms to exit.

DDT exemption will pave way for REITs launch

We may see introduction of REITs (Real Estate Investment Trust) in Indian market soon. The proposal that any distribution made out of income of SPV (special purpose vehicle) to the REITs and InvITs (Infrastructure Investment Trusts) having specified shareholding will not be subjected to Dividend Distribution Tax (DDT).

REITs are listed entities that primarily invest in leased office and retail assets, allowing developers to raise funds by selling completed buildings to investors and listing them as a trust. With most of the hurdles getting removed by the budget announcements, we may see introduction of REITs in Indian market soon. The introduction of REITs in India would spell scores of opportunities for developers, private funds, financial institutions and investors to diversify into yet another asset class.

Exemption on Sovereign Gold Bond Scheme

The Budget has proposed making the gains under the Sovereign Gold Bond Scheme 2015, exempt from tax. It also proposed indexation benefit on transfer of the gold bonds. This should provide incentive for investing in gold bonds instead of physical gold.

Reduction in time limit for filing of belated IT returns

The Budget has proposed to reduce the time-limit for filing of belated IT returns to any time before the end of the assessment year or completion of assessment, whichever is earlier. However, it has been proposed to allow a belated IT return to be revised within a year from the end of the relevant assessment year or completion of assessment, whichever is earlier.

This will reduce the time-limit for filing a belated IT return to 1 year from 2 years and encourage timely compliance. Revision of belated IT return will now be permitted, which was not possible earlier.

Amendment in Advance Tax payment schedule

Budget has proposed amendment in Advance Tax payment schedule for individuals as (a) 15 per cent of tax payable by June 15; (b) 45 per cent of tax payable by September 15; (c) 75 per cent of tax payable by December 15; and (d) 100 per cent of tax payable by March 15.

Withdrawal from National Pension Scheme on maturity tax free upto 40%

The Finance Minister announced that 40 per cent of the lumpsum amount withdrawn from National Pension System (NPS) would be made tax free. This is a big benefit considering the fact that earlier the entire amount of receipt was taxed as income.

This has implicitly made it attractive for investors to withdraw the corpus after 60 years (and not before) as any withdrawal before 60 years requires the utilisation of 80% of the corpus for purchasing annuity. This means that only 20% can be withdrawn before 60 years. Hence for getting the maximum tax benefit, it seems prudent to withdraw after 60 years. This is because after 60 years you can withdraw upto 60% of the corpus and out of this as per the new proposal 40% will be tax-free.

Tax on EPF and PPF

After public outcry regarding yesterday’s budget proposal to tax the EPF and PPF, the Government has come out with some clarifications today.

Only 60% of interest accrued on contribution made to EPF after April 1, 2016 will be taxed and thus 40% will be exempted. The principal amount will not be taxed and shall remain tax exempt. At present, the deposits, the interest and withdrawals of the EPF are tax free as it is an EEE scheme.

However, no tax on withdrawal and small salaried employees with up to Rs 15,000 per month income will be kept out of purview of proposed taxation of EPF.

No part of Public Provident Fund (PPF) will be taxed and the present scheme of investment up to र 1.5 lacs in a year will continue to be tax exempt. PPF on withdrawal will continue to be out of the tax ambit.

However we feel that some more clarity is needed on this context. We will update our readers on this as and when more information pours in.

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Union Budget 2016-17: A perspective

Mar 1, 2016

-

Highlights of Union Budget 2016

Feb 29, 2016

-

Mastering Communication for Influence Boot Camp

Nov 19, 2015

-

What determines a companys work culture: Answer that and you can be a great manager

May 19, 2014

-

Nandini Vaidyanathan named Business Woman of the year

May 2, 2014