Latest Saving, Investing & Mutual Fund Articles

SBI Banking and PSU Funds: A good debt fund in the current environment

May 23, 2020 / Dwaipayan BoseWith rising concern about credit risk among mutual fund investors, one debt fund category which is seeing a lot of investor interest in Banking and PSU funds. As the name suggests these funds invest in debt and money market instruments issued by banks, public sector undertakings and public financial institutions. The debt issued...Read More

Principal Focused Multicap Fund: A good focused equity fund for long term investments

May 20, 2020 / Advisorkhoj Research TeamPrincipal Focused Multi-cap Fundinvests in about 30 stocks of different sizes (large cap, midcap and small cap) with high growth potential across different industry sectors. As per SEBI’s mandate for focused funds, the maximum number of stocks in the scheme’s portfolio will be limited to 30 only. This scheme was launched in 2005 and has given...Read More

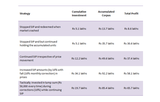

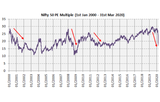

The lockdown imposed by the Government to arrest the spread of COVID-19 pandemic has resulted in significant economic slowdown and equity markets to turn volatile. Though the Government has gradually started re-opening the economy, the economic outlook is uncertain since large parts of the country including the major economic...Read More

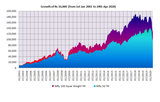

We have stated a number of times in our blog that Systematic Investment Plan is one of the best ways of wealth creation over a long investment horizon. The benefits of SIP viz. power of compounding, rupee cost averaging and disciplined investing are well known to our regular readers. We have discussed earlier in our blog that bear markets or deep...Read More

Principal Nifty 100 Equal Weight Fund: A good index fund for long term investments

Apr 28, 2020 / Dwaipayan BoseThe severe economic shock caused by COVID-19 triggered lockdown has stocks around the world in a meltdown. Though Nifty-50 has recovered 20% from the March 2020 lows, it is still down almost 25% on a year to date basis. With infections and fatalities rising in India and the roadmap to normalcy uncertain, stock specific risks can...Read More

We have stated a number of times in our blog that Systematic Investment Plan (SIP) is ideal mode of investment for your long term financial goals. Though SIP is very popular among retail investor in India, there is a misconception that SIP is type of investment. Whether you invest through SIP or lump sum, the risks characteristics of your...Read More

Nippon India ETF Nifty BeES: A good long term investment in current market

Apr 21, 2020 / Advisorkhoj Research TeamExchange traded funds (ETFs) are increasingly becoming popular among investors around the world and also here in India. ETFs invest in the basket of securities that replicates the composition of a market index like Sensex, Nifty, BSE – 100, Nifty – 100 etc. ETFs do not aim to beat market returns, their objective is to track and deliver...Read More

Spread of Coronavirus pandemic across the world has sent stock markets around the world in a free fall. From its all time high of nearly 42,000 in mid January, the Sensex broke below 26,000 levels towards the end of March 2020. Over the last 2 – 3 weeks we saw a good recovery in the market and the Sensex is now trading above the...Read More

To begin, I wish all our MFD Friends and their families to Stay Healthy and Stay Safe during this current period! This too shall pass over soon & we together shall emerge through this period winningly! Simply put, a CFOof a Company is responsible for managing the financial requirements of a company. Tracking cash flows, financial...Read More

If you want to invest in stocks, you should be well-versed with all the terminologies of the subject. You should know that investing in stocks means setting aside some money for investment so that you are rewarded with a huge profit in the future. It is like keeping money reserved to receive more inflow of money. You have to have a beginning, and...Read More